Highlights of the Week- Issue #61

Preview

Last week, El Salvador marks three years of Bitcoin adoption, holding 5,867 BTC, despite volatility and criticism. Mastercard have launched a Euro Bitcoin debit card for direct spending, while Zurich Cantonal Bank now offers Bitcoin trading and custody services. U.S. spot Bitcoin ETFs faced a $288 million outflow, the largest since May, yet continue to attract significant interest. Venezuelan leader María Corina Machado highlighted Bitcoin’s crucial role in overcoming economic collapse and authoritarianism in Venezuela. Meanwhile, Japan's Financial Services Agency proposed tax reforms to classify Bitcoin similarly to traditional assets, potentially reducing tax burdens. For more details, continue reading below.

A. Bitcoin Data Dashboard

B. Bitcoin Ecosystem

1. El Salvador marks three years as first nation to adopt Bitcoin, holding 5,867 BTC

2. Mastercard launch Euro debit card for direct Bitcoin spending

3. Zurich Cantonal Bank launches trading and custody services for Bitcoin

4. U.S. Spot Bitcoin ETFs face $288 million outflow in largest single-day drop since may

5. Venezuelan leader Machado: Bitcoin is crucial for economic recovery and freedom

6. U.S. companies to boost Bitcoin holdings; MicroStrategy outperforms Berkshire Hathaway

C. Regulation

1. Japan’s FSA proposes tax reform for Bitcoin and other cryptocurrencies

D. Macroeconomy

1. Jackson Hole meeting highlights central bankers' optimism with cautious economic outlook

2. U.S. debt ceiling reinstatement on January 2, 2025, could impact liquidity and markets

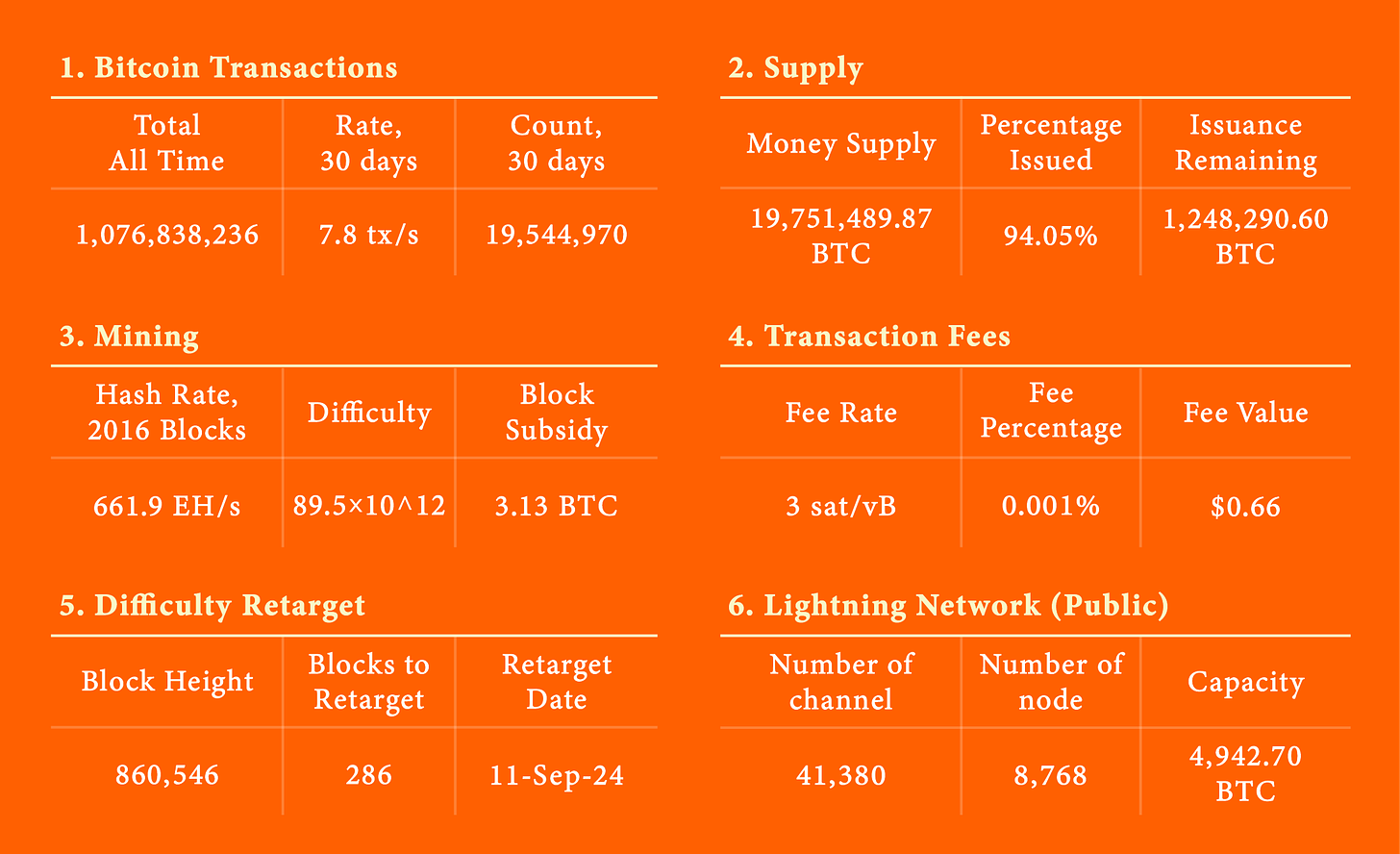

A. Bitcoin Data Dashboard

As of Sep 9, 2024

B. Bitcoin Ecosystem

1. El Salvador marks three years as first nation to adopt Bitcoin, holding 5,867 BTC

El Salvador is celebrating three years of being the first country to adopt Bitcoin as legal tender, a move made on September 7, 2021. This ambitious decision aimed to boost financial inclusion, simplify remittance payments, and attract technological innovation. The country’s bold experiment has shown mixed but promising results. El Salvador’s Bitcoin holdings have accumulated to 5,867 BTC, despite significant price fluctuations and initial criticism. The country’s Bitcoin portfolio, now valued at around $314 million, reflects a strategic investment, even as Bitcoin’s price has varied widely. The global reaction has been mixed; while El Salvador’s move was expected to inspire others, only the Central African Republic has similarly adopted Bitcoin. Larger economies have been cautious, often due to their complex relationships with international creditors and financial institutions. This caution has been reinforced by pressure from organizations like the IMF. Nonetheless, El Salvador’s pioneering approach has prompted discussions about Bitcoin’s potential in global financial systems and its future in institutional adoption.

Reference: Cointelegraph, Nayib Bukele Portfolio Tracker

2. Mastercard launch Euro debit card for direct Bitcoin spending

Mastercard has announced a new partnership with payments provider Mercuryo to introduce a euro-denominated debit card that allows users to spend Bitcoin and other cryptocurrencies directly from non-custodial wallets. This innovative card, aimed at European Bitcoin holders, enables them to make purchases at Mastercard’s extensive network of over 100 million merchants worldwide without the need to transfer funds through an intermediary. Mastercard, a global leader in payment solutions with nearly 3 billion customers across more than 210 countries, is expanding its reach into the bitcoin space. This integration reflects the company’s commitment to bridging digital assets with its traditional payments infrastructure. According to Christian Rau, Senior Vice President of Mastercard, the card provides a secure and convenient way for consumers to spend their digital assets anywhere Mastercard is accepted. Users can connect their non-custodial wallets to the card, allowing them to spend their Bitcoin and other cryptocurrencies directly without needing to convert them into fiat currency through an exchange. This feature maintains full ownership of the digital assets and avoids the complexities and costs associated with traditional exchanges.

Reference: Bitcoin magazine

3. Zurich Cantonal Bank launches trading and custody services for Bitcoin

Zurich Cantonal Bank (ZKB), one of Switzerland’s largest financial institutions, has

expanded its offerings to include bitcoin trading and custody services. Announced on September 4, ZKB now enables customers to trade Bitcoin directly through its eBanking and Mobile Banking platforms, integrating these holdings into their existing portfolio views. The bank will also manage private key storage internally, ensuring high levels of security and eliminating the need for customers or third-party banks to handle private keys themselves. ZKB’s new service is available to both individual clients and other banks, allowing Swiss banks to offer bitcoin trading and secure storage to their customers through ZKB’s B2B solution.

Reference: Cointelegraph

4. U.S. Spot Bitcoin ETFs face $288 million outflow in largest single-day drop since may

U.S. spot Bitcoin ETFs experienced a substantial outflow of $287.8 million in a single day, the largest since May 1, as reported by Farside Investors. BlackRock’s ETF was the only one that did not face withdrawals. Leading the outflows was Fidelity’s ETF, which saw $162 million withdrawn. Grayscale followed with $50 million in outflows, while Ark and Bitwise reported withdrawals of $34 million and $25 million, respectively. Despite these significant withdrawals, these ETFs collectively manage around $50 billion in assets, indicating their substantial scale and impact in the market. Earlier this year, Bitcoin's price surged dramatically, driven by the enthusiasm surrounding these ETFs. Starting at about $44,000 at the beginning of 2024, Bitcoin reached an all-time high of $73,770 on March 14. Since then, the price has stabilized between $55,000 and $65,000, marking a period of consolidation 174 days after its peak, according to Clark Moody Dashboard. Despite the recent outflows, spot Bitcoin ETFs have largely maintained strong inflows over the past eight months, with only one month of net outflows. This ongoing investor interest suggests that while Bitcoin’s price has stabilized, the long-term demand for Bitcoin and related investment vehicles remains strong.

Reference: Bitcoin magazine

5. Venezuelan leader Machado: Bitcoin is crucial for economic recovery and freedom

Venezuelan opposition leader María Corina Machado discussed Bitcoin’s critical role in addressing Venezuela's economic collapse and authoritarian rule. The interview underscores the severe effects of hyperinflation under Chávez and Maduro, which has led to the bolívar losing 14 zeros and inflation peaking at 1.7 million percent in 2018. Machado described the economic devastation caused by state-sponsored looting, theft, and unchecked money printing, despite Venezuela's vast oil reserves. She emphasized how Bitcoin has become a "lifeline" for many Venezuelans, offering a means to bypass hyperinflation and government-controlled exchange rates. Bitcoin has also enabled individuals to protect their wealth and fund their escape from the country. Machado proposed incorporating Bitcoin into Venezuela’s national reserves as part of a broader strategy to recover stolen wealth and rebuild from the dictatorship. She sees Bitcoin as crucial for ensuring financial autonomy, transparency, and property rights in a future democratic Venezuela. Machado highlighted the role of Bitcoin in the opposition’s efforts to reclaim democracy and rebuild the nation.

Reference: Bitcoin magazine

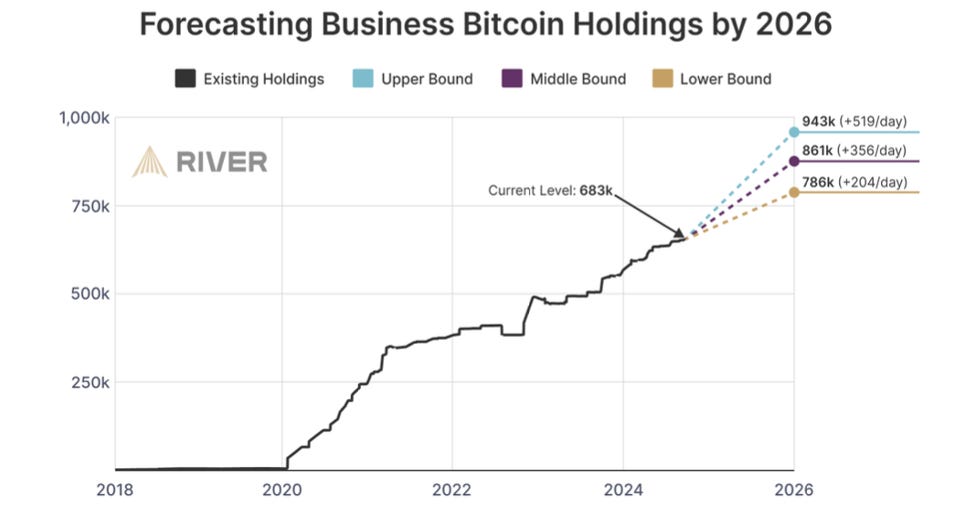

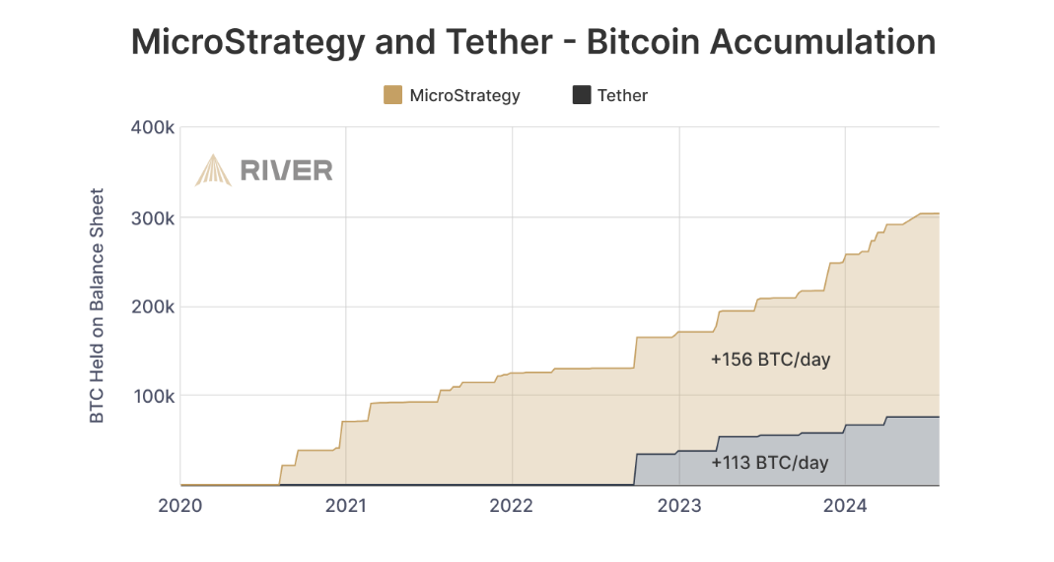

6. U.S. companies to boost Bitcoin holdings; MicroStrategy outperforms Berkshire Hathaway

A new report from River, a Bitcoin technology firm, forecasts that 10% of U.S. companies will convert 1.5% of their treasury reserves—around $10.35 billion— to Bitcoin over the next 18 months. River highlights that traditional cash and short-term investments often fail to keep up with inflation, diminishing their value. The report draws attention to MicroStrategy’s corporate treasury strategy, popularized by founder Michael Saylor, who views Bitcoin as a hedge against inflation and a store of value with "economic immortality." In June 2024, MicroStrategy raised $800 million to buy an additional 11,931 BTC, bringing its total holdings to 226,500 BTC, valued at approximately $14.7 billion. MicroStrategy’s Bitcoin strategy has led to a 1,000% increase in its stock value, significantly outperforming Berkshire Hathaway's 104.75% rise.

Reference: Cointelegraph

C. Regulation

1. Japan’s FSA proposes tax reform for Bitcoin and other cryptocurrencies

Japan’s Financial Services Agency (FSA) has unveiled plans for a significant tax code overhaul for fiscal year 2025, focusing on reducing the tax burden on cryptocurrency assets. In its reform request submitted on August 30, the FSA proposed that cryptocurrencies be classified similarly to traditional financial assets, which could lead to a lower tax rate for bitcoin investments. Currently, profits from cryptocurrency transactions in Japan are taxed as miscellaneous income at rates ranging from 15% to 55%. The highest rate applies to earnings exceeding ¥200,000 ($1,377), but this varies based on the individual’s income bracket. In comparison, profits from stock trading are taxed at a flat maximum rate of 20%. Additionally, corporate holders of cryptocurrencies face a flat 30% tax on their holdings, even if no profits are realized from sales. The proposed reform seeks to align the tax treatment of cryptocurrencies with that of other financial assets.

Reference: Cointelegraph

D. Macroeconomy

1. Jackson Hole meeting highlights central bankers' optimism with cautious economic outlook

At the recent Jackson Hole meeting, central bankers displayed a shift from prior pessimism to a more optimistic outlook on global economies. Fed Chair Jay Powell signaled a readiness to adjust U.S. monetary policy, noting that recent inflation was driven largely by pandemic-related supply chain issues. Powell highlighted that easing inflation and a stable labor market provide room for potential interest rate cuts. As a result, bond yields and the US dollar fell, reflecting market reactions to his comments. Overall, the Jackson Hole meeting conveyed a generally positive attitude towards the major economies, though it was not without caution. Federal Reserve Bank of Chicago President pointed out that monetary policy effects can be delayed, raising concerns about whether recent tightening could still produce negative outcomes and if these could be mitigated by a swift policy easing. The full impact of current policies remains to be seen, with time necessary to assess their long-term effects.

Reference: Delloitte insights

2. U.S. debt ceiling reinstatement on January 2, 2025, could impact liquidity and markets

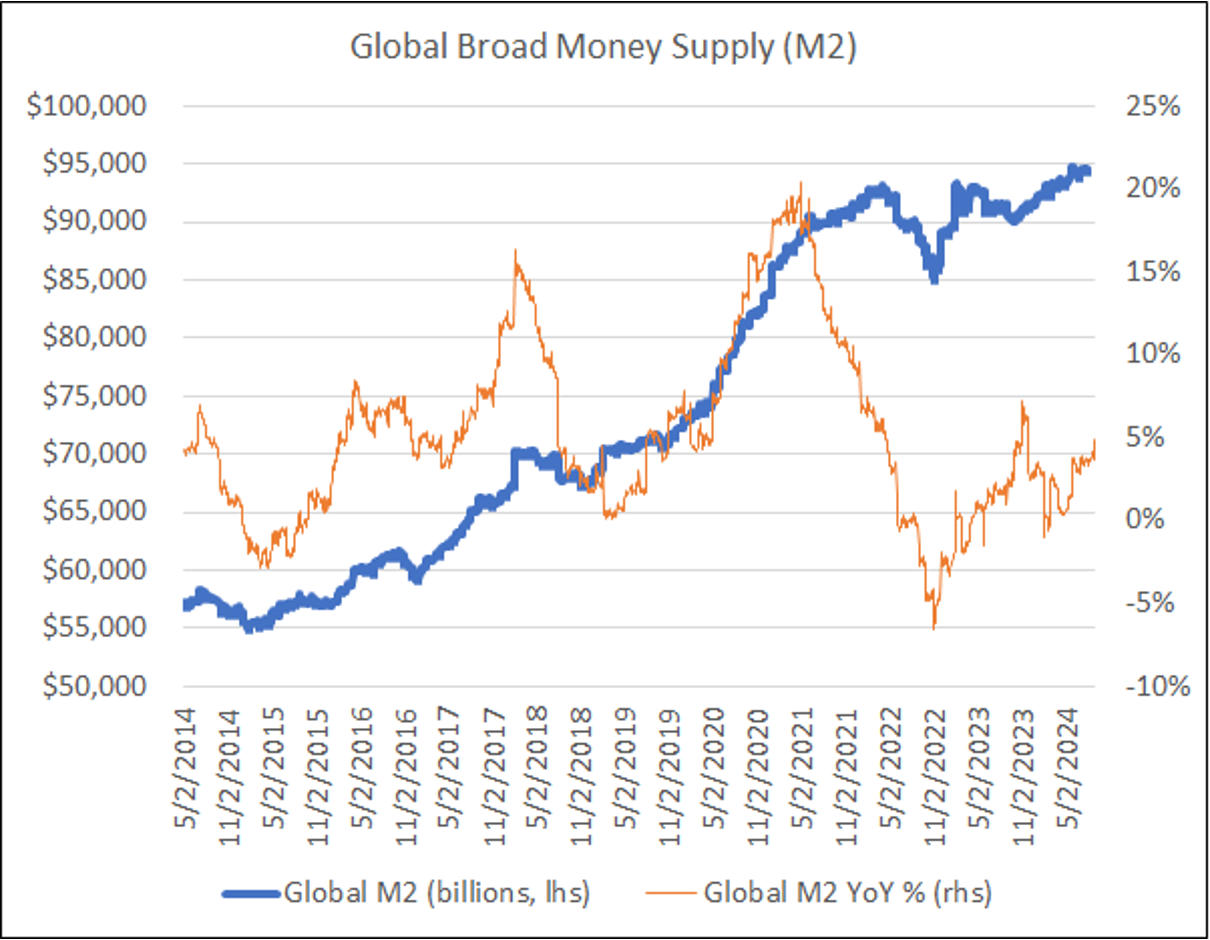

On January 2, 2025, the U.S. debt ceiling will be reinstated, having been suspended by the 2023 deal. If Congress does not raise it, the Treasury will need to cut its cash balance—currently over $700 billion—to keep paying bills without issuing new debt, potentially leading to a technical default. Historically, a Republican-controlled Congress has used the debt ceiling to negotiate with Democratic presidents, though the reverse has not yet occurred. The outcome largely depends on election results. Liquidity conditions are crucial as they strongly correlate with financial and asset markets in the era. Domestic liquidity influences the banking system and the dollar index, impacting global conditions. Global liquidity, measured as the broad money supply of major currencies in dollar terms, has remained stable. Recent support from a weaker dollar index has been offset by stagnant money supply growth in China since March 2024, limiting global liquidity growth.

Reference: Lyn Alden