Highlights of the Week- Issue #60

Preview

Last week, President Nayib Bukele of El Salvador emphasized Bitcoin’s role in enhancing the country's global image that boosted foreign investment and tourism. At the NostrWorld Unconference in Riga, the synergy between Bitcoin and decentralized social networks was a key focus, showcasing the potential for integrating Bitcoin with the growing Nostr protocol. Meanwhile, Lightspark launched its Extend platform, facilitating instant Bitcoin payments for U.S. businesses, thereby expanding the accessibility of Bitcoin transactions. Publicly traded companies have increased their Bitcoin holdings by nearly 200%, bringing their total to $20 billion, reflecting strong institutional confidence in Bitcoin as a reserve asset. Additionally, Bitcoin in exchange experienced its third-largest daily net outflow of 2024, indicating a shift toward long-term holding among investors. Despite some withdrawals, including a $13.5 million outflow from BlackRock’s iShares Bitcoin Trust, the fund remains a dominant force in the Bitcoin investment landscape. Lastly, Nigeria's SEC granted its first provisional exchange license, a milestone in the regulation of the country’s rapidly growing digital asset industry, positioning Nigeria as a leading player in global digital asset adoption. For more details, continue reading below.

A. Bitcoin Data Dashboard

B. Bitcoin Ecosystem

1. Bukele: Bitcoin was a powerful rebranding tool for El Salvador

2. NostrWorld Unconference in Riga: Exploring Bitcoin and Decentralized Social Networks

3. Lightspark launches Extend for instant Bitcoin Lightning payments in the U.S.

4. Public companies boost Bitcoin holdings by nearly 200%, reaching $20 billion

5. Bitcoin exchanges see 3rd-largest daily net outflow of 2024

6. BlackRock's iShares Bitcoin Trust faces $13.5m outflow amid broader ETF withdrawals

C. Regulation

D. Macroeconomy

1. Vice President Harris proposes wealth tax targeting unrealized gains for ultra rich

2. Jobless claims drop as labor market slows, US economy remains on steady growth path

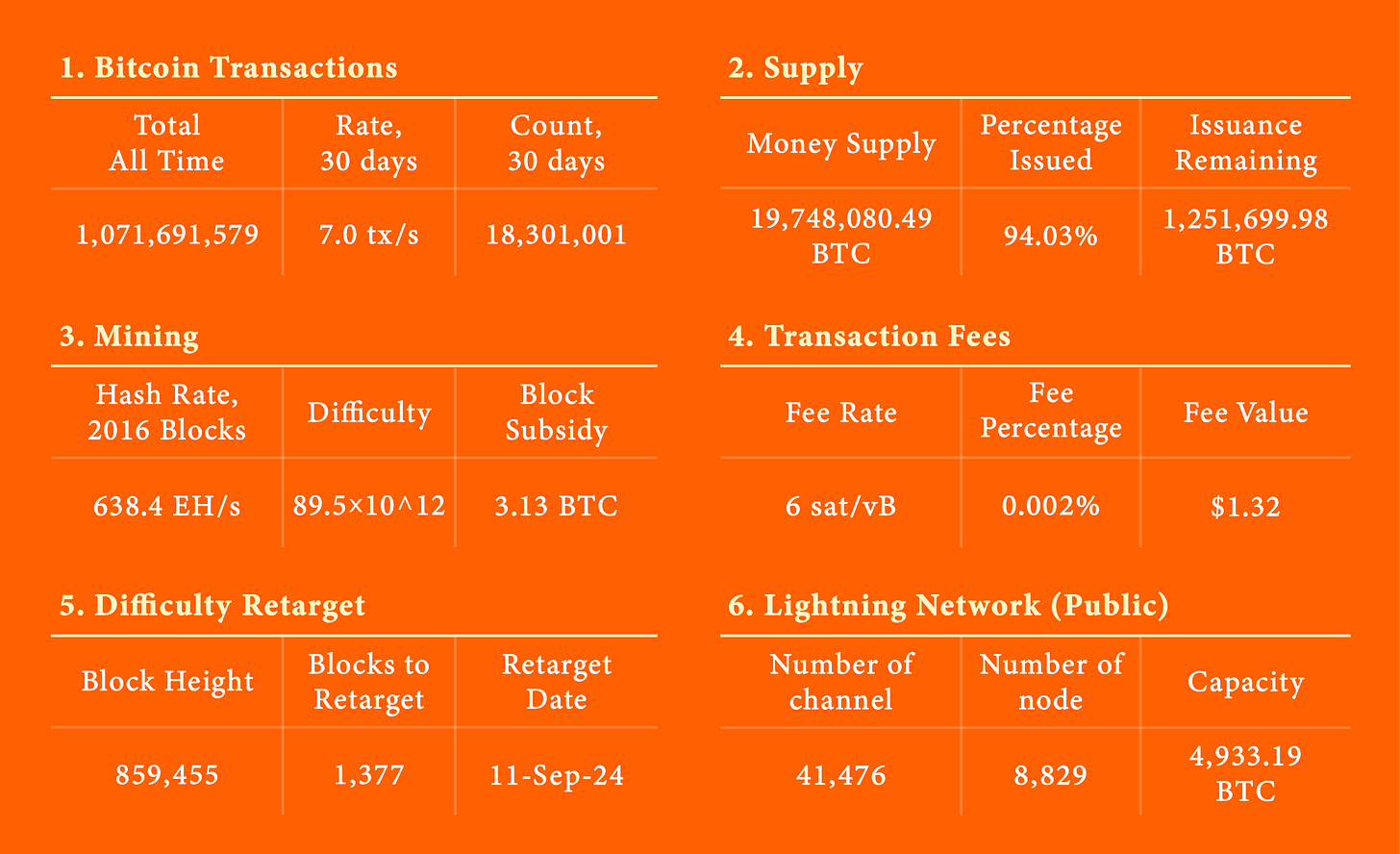

A. Bitcoin Data Dashboard

As of Sep 2, 2024

B. Bitcoin Ecosystem

1. Bukele: Bitcoin was a powerful rebranding tool for El Salvador

President Nayib Bukele recently provided a candid assessment of El Salvador's groundbreaking decision to adopt Bitcoin as legal tender, a move that has drawn both praise and criticism on the global stage. In an interview with Time magazine, Bukele emphasized that the initiative has had substantial benefits particularly in enhancing El Salvador's international image despite the country's bitcoin adoption has not expanded as rapidly as he has hoped, Bukele described the Bitcoin adoption as a powerful rebranding tool for the nation, one that has attracted foreign investment and boosted tourism. The president’s marketing advisor, Damian Merlo, echoed this sentiment, calling the decision "genius" and likening it to a major public relations campaign that El Salvador didn’t have to pay for. "We could have spent millions on a PR firm to rebrand the country," Merlo noted, "but instead, we adopted Bitcoin." While the move initially strained relations with institutions like the International Monetary Fund (IMF), which urged Bukele to abandon the policy due to perceived risks, there are signs that the tension is easing. El Salvador has recently reported progress in negotiations with the IMF, with a focus on enhancing transparency and addressing potential fiscal and financial stability risks related to the Bitcoin project.

Reference: Bitcoin.com, Time

2. NostrWorld Unconference in Riga: Exploring Bitcoin and Decentralized Social Networks

Last week, NostrWorld’s third unconference, held in Riga, Latvia, gathered advocates and developers of the Nostr protocol. Organized by Jack Dorsey, NostrWorld provides a platform for open-source enthusiasts to collaborate on building a decentralized internet. The event, called Nostriga, underscored the emerging synergy between Nostr’s decentralized social network and Bitcoin. Nostr is an open-source protocol for a decentralized, censorship-resistant social network. Unlike traditional platforms, Nostr operates on a network of relays, supporting features like micropayments and digital identity management. It promises greater privacy and independence from centralized platforms. A highlight of the conference was Strike CEO Jack Mallers discussing how Nostr’s micropayments—Zaps—helped a skeptic understand Bitcoin’s value. This feature shows Bitcoin’s utility in social contexts, advancing the concept of internet tipping. Jack Dorsey enphasizing the importance of open source. Nostr faces the challenge of broadening its user base beyond Bitcoin enthusiasts. New initiatives like Ditto aim to integrate Nostr with larger internet communities, potentially increasing Bitcoin’s visibility and accessibility. Nostr’s role as a social and identity system could pave the way for decentralized digital economies. By leveraging social graphs and cryptographic trust, Nostr and Bitcoin together could enable secure, decentralized commerce.

Reference: Bitcoin magazine

3. Lightspark launches Extend for instant Bitcoin Lightning payments in the U.S.

Lightspark has unveiled Lightspark Extend, a new solution designed to facilitate instant Bitcoin Lightning payments for U.S. businesses. This platform integrates with Universal Money Addresses (UMA) and Lightning-enabled wallets, exchanges, or bank accounts, offering a compliant and cost-effective way to handle transactions around the clock. Lightspark Extend is compatible with over 99% of U.S. banks that support real-time payments, enabling businesses to provide their customers with fast, low-cost transactions. UMA simplifies the payment process by using easy-to-remember addresses similar to email, removing the need for complex codes or passwords. With this launch, Lightspark Extend makes real-time payments via the Bitcoin Lightning Network accessible to eligible recipients across the U.S. Businesses interested in adopting this solution can sign up for a UMA address, link their accounts, and start receiving payments through an onboarding process facilitated by Zero Hash, a regulated U.S. financial institution. The introduction of Lightspark Extend marks a significant advancement in expanding the accessibility and utility of Bitcoin payments. This follows Lightspark’s recent announcement of a partnership with Coinbase, enabling customers to send up to $10,000 instantly through the Lightning Network.

Reference: Bitcoin magazine

4. Public companies boost Bitcoin holdings by nearly 200%, reaching $20 billion

Publicly listed companies have seen their Bitcoin holdings soar by nearly 200% in a year, rising from $7.2 billion to $20 billion. According to Bitbo data, 42 such companies now hold 335,249 BTC, valued at roughly $20 billion. This marks a 177.7% increase from a year ago, when their BTC holdings were worth $7.2 billion. The trend began with MicroStrategy's August 2020 purchase of over 21,000 BTC, making Bitcoin its primary treasury reserve asset, and the company has since grown its holdings to 226,500 BTC. A survey commissioned by Nickel Digital Asset Management revealed strong institutional support for Bitcoin as a reserve asset, with 75% of 200 surveyed institutional investors and wealth managers endorsing public companies holding BTC. The survey, involving firms managing $1.7 trillion in assets, also found that 58% believe 10% or more of public companies will hold BTC within five years. Nickel Digital's CEO, Anatoly Crachilov, noted that institutional investors see Bitcoin as a hedge against currency debasement and a valuable addition to reserve allocations. Despite this growth, the 335,249 BTC held by public companies represent just 1.6% of Bitcoin's total capped supply of 21 million.

Reference: Cointelegraph

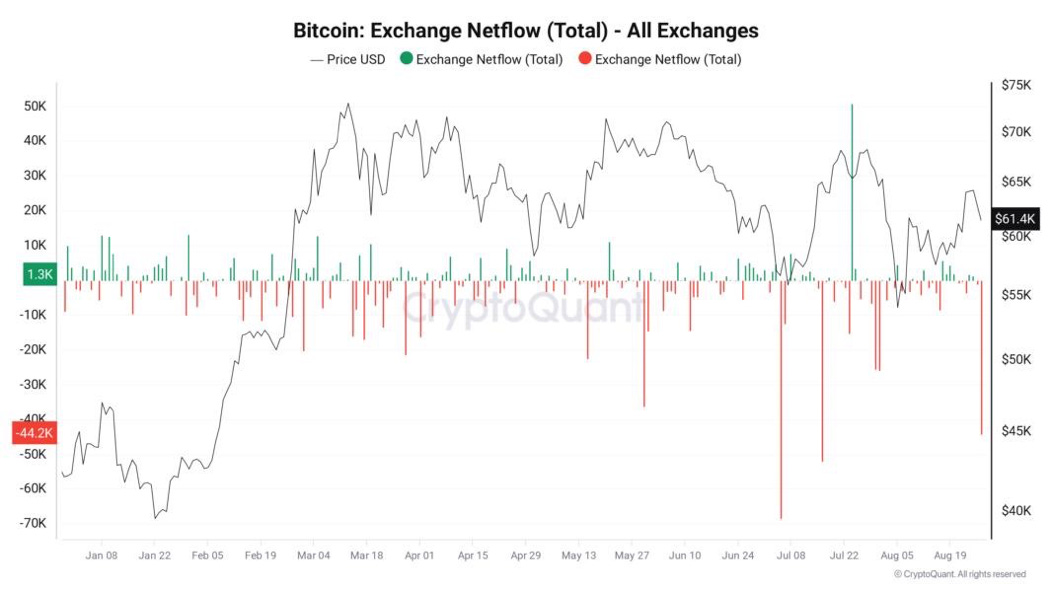

5. Bitcoin exchanges see 3rd-largest daily net outflow of 2024

Bitcoin is seeing a significant uptick in exchange withdrawals as its price nears the $60,000 mark, with approximately 45,000 BTC removed from exchanges on August 27 alone. This movement represents the third-largest net outflow of Bitcoin from exchanges in 2024, following similar spikes in July. According to data from CryptoQuant, this trend could signal a growing bullish sentiment among investors, who appear to be transferring their Bitcoin off exchanges to hold for the long term, thereby reducing potential selling pressure in the market. As of August 27, major exchanges hold around 2.63 million BTC, reflecting a 12.5% decrease from the 3.01 million BTC held at the beginning of the year. This reduction in exchange reserves underscores a broader trend of investors preferring to hold their Bitcoin privately, possibly in anticipation of future price increases.

Reference: Cointelegraph

6. BlackRock's iShares Bitcoin Trust faces $13.5m outflow amid broader ETF withdrawals

BlackRock's iShares Bitcoin Trust (IBIT) experienced a $13.5 million outflow on Thursday, marking its first outflow since May 1st and only the second in the fund's history since its launch in January. This rare withdrawal contrasts with the ETF’s usual pattern of consistent inflows, underscoring its dominance in the Bitcoin investment space. The outflow came as part of a broader trend affecting spot Bitcoin ETFs, which saw a collective $71.8 million in withdrawals on Thursday. Competing Bitcoin ETFs from Grayscale, Fidelity, Valkyrie, and Bitwise also reported significant outflows, ranging from $8 million to $31 million. Despite these withdrawals, ARK's Bitcoin ETF saw an inflow of $5.3 million, highlighting a mixed investor sentiment as Bitcoin remains below the $60,000 mark. This divergence suggests varied outlooks among investors regarding Bitcoin's future. Despite the recent dip, BlackRock's Bitcoin ETF continues to lead the market, having attracted over $20 billion in net inflows since inception. With more than 350,000 BTC under management, it remains one of the largest institutional Bitcoin holders, reflecting its enduring appeal and influence in the Bitcoin investment landscape.

Reference: Bitcoin magazine

C. Regulation

1. Nigeria's first provisional exchange license from SEC, marking milestone in digital asset regulation

The Nigerian Securities and Exchange Commission (SEC) has granted Quidax, an Africa-based crypto exchange, its first provisional operating license. This marks a significant step toward formal recognition and regulation of Nigeria's digital asset industry. The SEC's license allows Quidax to operate as a registered crypto exchange in Nigeria, a move the company describes as a "shot of adrenaline" for the local crypto community, spurring innovation and growth. Quidax CEO Buchi Okoro praised the SEC, particularly under the leadership of Emomotimi Agama, for its efforts to bring order and investor protection to the Nigerian crypto market. The approval also paves the way for Quidax to collaborate with banks and financial institutions, pending approval from the Central Bank of Nigeria. This licensing follows the SEC's recent amendment to its rules on June 21, covering digital asset issuance, exchange, and custody. Despite concerns that stringent requirements could limit local crypto exchanges, the new regulatory framework, including the Accelerated Regulatory Incubation Programme, aims to align virtual asset service providers with the latest standards. Nigeria, Africa's largest economy, is a global leader in cryptocurrency adoption, ranking second in Chainalysis’ 2023 Cryptocurrency Geography Report. While foreign investment in Nigeria's crypto sector has been slower than expected, the new regulatory environment and Quidax's licensing could attract more investors by offering a stable and secure market.

Reference: Cointelegraph

D. Macroeconomy

1. Vice President Harris proposes wealth tax targeting unrealized gains for ultra rich

As a presidential candidate, Vice President Harris has aligned with President Biden’s tax policies, including the pledge not to raise taxes on anyone earning under $400,000 annually. However, she also has her own ambitious tax proposals. These include raising the top marginal tax rate on high earners from 37% to 39.6%. Although she previously suggested a 4% “income-based premium” on households earning over $100,000 to fund Medicare for All, this idea has not resurfaced in 2024. Among the more controversial proposals Harris supports is a tax on unrealized capital gains for individuals with over $100 million in wealth. Often dubbed the “billionaire tax,” this would require these households to pay an annual minimum tax of 25% on their combined income and unrealized gains. This approach would be groundbreaking in U.S. tax history, as it taxes assets that have not yet been sold. For example, if you buy stock at $10 and it increases to $20, you would owe taxes on the $10 gain, even if you haven’t sold the stock. The same principle would apply to real estate, where yearly value increases would be taxed. This proposal raises significant concerns, particularly about the administrative challenges of valuing assets annually and the potential for future expansion of the tax to lower wealth thresholds. The wealth tax faces hurdles in Congress and potential court challenges, but it signals Harris's intent to push for new forms of taxation on the ultra-wealthy.

Reference: Forbes

2. Jobless claims drop as labor market slows, US economy remains on steady growth path

Last week, new applications for jobless benefits in the U.S. dropped slightly, but re-employment opportunities for laid-off workers are becoming scarcer, indicating the unemployment rate likely remained high in August. Despite this, the labor market's orderly slowdown is keeping economic growth on track, with the economy growing faster than initially reported in the second quarter, driven by consumer spending and rebounding corporate profits. The labor market's cooling supports the expectation that the Federal Reserve may start cutting interest rates next month, though a 50-basis-point reduction seems unlikely. Initial jobless claims fell by 2,000 to 231,000 for the week ending August 24, while continuing claims, which indicate ongoing unemployment, rose slightly, suggesting prolonged joblessness. In the second quarter, the economy grew at an annualized rate of 3.0%, with consumer spending revised upward to a 2.9% growth rate, offsetting lower business investment and exports. Corporate profits also reached a record high, helping businesses manage input costs amid supply-chain challenges. The goods trade deficit widened in July due to a surge in imports, likely driven by expectations of higher tariffs if former President Trump wins the November election. Despite these factors, economists predict growth will slow but avoid a recession.