Highlights of the Week- Issue #58

Preview

Last week, Norway's sovereign wealth fund has increased its indirect Bitcoin exposure to over $144 million through investments in firms like MicroStrategy, reflecting Bitcoin's growing role in diversified portfolios. Marathon Digital has invested $249 million in Bitcoin following a senior note offering, despite facing a 34% stock drop due to sector challenges. In Q2 2024, institutional interest in Bitcoin ETFs grew, with significant purchases from Goldman Sachs and others. South Korea’s National Pension Service has bought $34 million in MicroStrategy shares, while the U.S. launched its first leveraged Bitcoin ETF, MSTX. Argo Blockchain repaid a $35 million loan from Galaxy Digital, and the Bank of Ghana proposed new crypto regulations to enhance consumer protection. Meanwhile, BRICS is advancing a payment system to rival SWIFT, with 159 countries showing interest, and U.S. unemployment claims dropped to a one-month low, easing speculation about a major Federal Reserve rate cut. For more details, continue reading below.

A. Bitcoin Data Dashboard

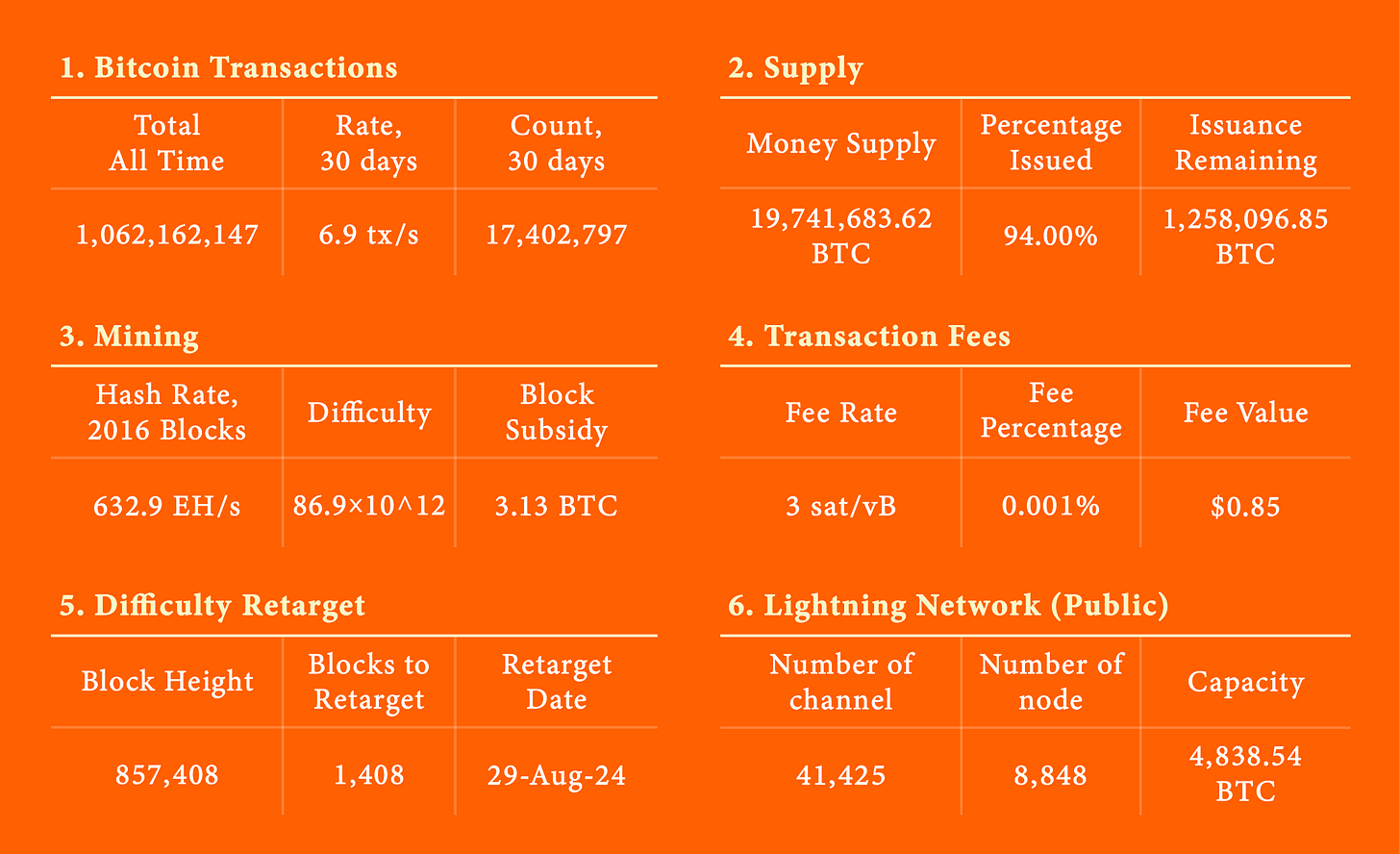

1. Bitcoin Transactions

2. Supply

3. Mining

4. Transaction Fees

5. Difficulty Retarget

6. Lightning Network (Public)

B. Bitcoin Ecosystem

1. Norwegian Sovereign Wealth Fund’s $144m Bitcoin exposure

2. Marathon Digital invests $249M in Bitcoin after $300M senior note offering

3. 66% of institutional investors increase Bitcoin ETF holdings in Q2 2024 despite market decline

4. Goldman Sachs, Capula, and Avenir lead $1.3 billion Bitcoin ETF purchases in Q2 2024

5. South Korea’s National Pension Service invests $34m in MicroStrategy shares

6. U.S. launches first leveraged Bitcoin ETF, MSTX, offering 175% daily exposure to MicroStrategy

7. Argo Blockchain repays $35M loan from Galaxy Digital

C. Regulation

1. Bank of Ghana proposes new crypto regulations to combat fraud and enhance consumer protection

D. Macroeconomy

1. BRICS advances new payment system to rival SWIFT, with 159 countries ready to adopt

2. U.S. unemployment claims drop to one-month low, easing rate cut hopes

A. Bitcoin Data Dashboard

As of Aug 19. 2024

B. Bitcoin Ecosystem

1. Norwegian Sovereign Wealth Fund’s $144m Bitcoin exposure

Norwegian sovereign wealth fund recent increased in indirect Bitcoin exposure, now valued at over $144 million. analysy suggest that it is likely a result of automated sector weighting and risk diversification rather than a deliberate strategy. According to K33 Research, the fund's 160.7% rise in indirect Bitcoin holdings since December 2023—achieved through expanded investments in companies like MicroStrategy and Marathon Digital—illustrates Bitcoin’s growing role in diversified portfolios. Analyst argued that if the increase had been intentional, there would be more direct evidence of Bitcoin investment initiatives. Instead, the fund’s indirect exposure reflects a broader trend of Bitcoin’s integration into established investment strategies. Analyst also noted that each Norwegian indirectly holds about $27 worth of Bitcoin, highlighting how Bitcoin is becoming a more integrated asset in global financial portfolios.

Reference: Cointelegraph

2. Marathon Digital invests $249M in Bitcoin after $300M senior note offering

Bitcoin miner Marathon Digital has recently spent $249 million on Bitcoin following a $300 million senior note offering. On August 14, the company revealed it used part of the proceeds to acquire 4,144 BTC at an average price of about $59,500, raising its strategic Bitcoin reserve to over 25,000 BTC. The offering, which yielded net proceeds of approximately $292.5 million, features a 2.125% annual interest rate and can be converted into cash, Marathon stock, or both. The remaining funds are earmarked for further Bitcoin purchases and general corporate purposes, including potential strategic acquisitions. Despite this aggressive acquisition strategy, Marathon’s stock has dropped nearly 34% year-to-date and recent earnings fell short of Wall Street estimates. The broader Bitcoin mining sector is facing profitability challenges, exacerbated by recent Bitcoin halving events that have reduced mining rewards and driven hash to record lows.

Reference: Tradingview

3. 66% of institutional investors increase Bitcoin ETF holdings in Q2 2024 despite market decline

In the second quarter of 2024, around 66% of institutional investors either held or increased their Bitcoin holdings through U.S.-based spot ETFs, as reported by Bitwise. Specifically, 44% of asset managers increased their Bitcoin ETF positions, while 22% maintained their holdings. Only 21% reduced their positions, and 13% exited, reflecting a solid performance in line with other ETFs, according to Bitwise CIO Matt Hougan. Despite Bitcoin's 14.5% decline in value over the quarter, institutional interest in Bitcoin ETFs continued to grow, with a 30% increase from Q1. Hougan emphasized that institutional investors demonstrated resilience, avoiding panic selling during market volatility, highlights the ongoing significant involvement of major financial players in Bitcoin ETFs.

Reference: Farside Investor,Cointelegraph

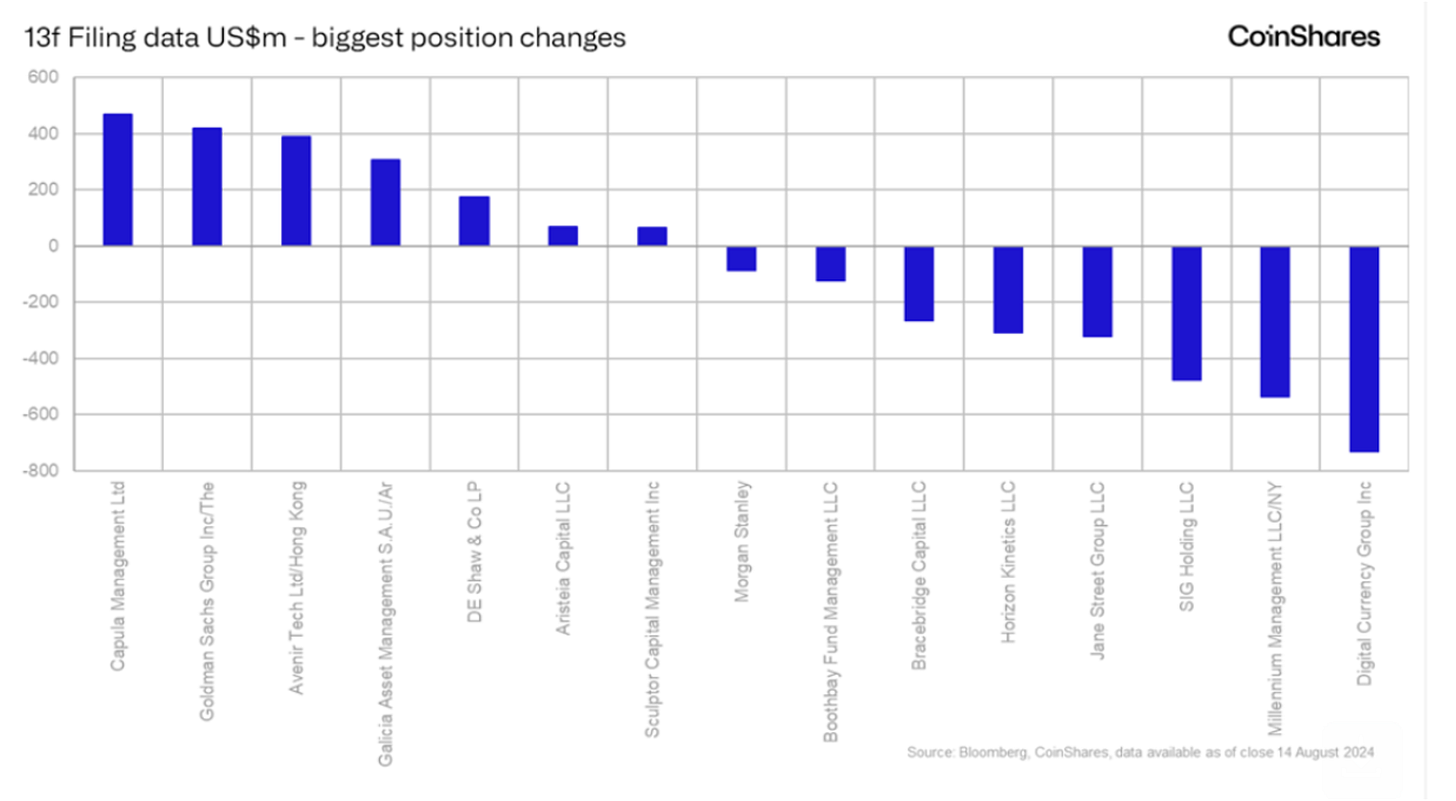

4. Goldman Sachs, Capula, and Avenir lead $1.3 billion Bitcoin ETF purchases in Q2 2024

In the second quarter of 2024, asset managers Goldman Sachs, Capula Management, and Avenir Tech emerged as the largest buyers of Bitcoin exchange-traded funds (ETFs), collectively investing nearly $1.3 billion in shares, according to CoinShares Research. Capula Management led with approximately $470 million in Bitcoin ETF purchases, while Goldman Sachs acquired $419 million and Avenir Tech bought $388 million worth. This significant investment underscores the strong demand for Bitcoin ETFs, which have seen substantial inflows since their launch in January, bolstered by institutional interest from firms like Morgan Stanley. Despite this, adoption among banks and pension funds remains minimal, with these institutions holding negligible Bitcoin allocations. CoinShares also reported that hedge funds hold the highest average Bitcoin allocations at 2.2%, followed by private equity firms with 1.4%. The continued involvement of major financial institutions suggests that cryptocurrency ETFs are likely to become a larger component of institutional investment portfolios over time.

Reference: Cointelegraph

5. South Korea’s National Pension Service invests $34m in MicroStrategy shares

South Korea’s National Pension Service (NPS), the world’s third-largest public pension fund, has recently purchased nearly $34 million worth of shares in MicroStrategy, acquiring 24,500 shares for a total of $33.75 million, according to an August 13 filing with the SEC. The NPS, which had over 1 trillion won ($777 billion) in assets as of February, also holds substantial stakes in other tech and bitcoin-related companies, including over $51 million in Coinbase shares and $61.5 million in Jack Dorsey’s Block. MicroStrategy’s stock has soared 92.5% in 2024, largely due to the company’s aggressive Bitcoin buying strategy. MicroStrategy now holds 226,500 BTC, worth around $13.19 billion, making it the public company with the largest Bitcoin holdings, significantly surpassing the world's largest Bitcoin miner, Marathon Digital. This significant increase in stock value and Bitcoin holdings underscores MicroStrategy’s growing influence in the market, and has attracted further interest from investors.

Reference: CoinDesk

6. U.S. launches first leveraged Bitcoin ETF, MSTX, offering 175% daily exposure to MicroStrategy

The U.S. has launched its first leveraged Bitcoin-related ETF, the MSTX, which aims to deliver 175% daily long exposure to MicroStrategy. This new fund offers investors enhanced leverage to Bitcoin through MicroStrategy’s high beta relative to Bitcoin itself. MSTX amplifies the potential for investors seeking significant leveraged exposure to the Bitcoin market. With Bitcoin ETFs previously contributing around 75% of new Bitcoin investments, MSTX could attract substantial interest. The ETF comes at a time when MicroStrategy has outperformed Bitcoin, with its shares rising over 70% in the past six months compared to Bitcoin’s 13% increase. Designed for sophisticated investors due to its inherent volatility, MSTX is expected to be one of the most volatile ETFs on the U.S. market.

Reference: Cointelegraph

7. Argo Blockchain repays $35M loan from Galaxy Digital

Bitcoin miner Argo Blockchain has successfully repaid a $35 million loan from Galaxy Digital, which was originally secured in 2022 to prevent bankruptcy amid the severe crypto bear market. This repayment, detailed in an August 12 filing, was completed without affecting its mining hashrate. In December 2022, to avoid financial collapse, Argo sold its Helios mining facility for $65 million and took the loan from Galaxy Digital, which was secured by Argo’s mining equipment. Argo has continued to grow its mining capabilities since then, deploying approximately 2,750 BlockMiner machines in Q3 2023 and achieving a hashrate of 2.7 EH/s by year-end. Galaxy Digital now plans to expand and monetize the power capacity at the Helios facility, anticipating increased demand from artificial intelligence and high-performance computing projects.

Reference: Cointelegraph,SEC.GOV

C. Regulation

1. Bank of Ghana proposes new crypto regulations to combat fraud and enhance consumer protection

The Bank of Ghana (BoG) has proposed new regulatory measures for digital assets following a detailed review of cryptocurrencies like Bitcoin and USDT. On August 16, the BoG released draft guidelines seeking public and industry feedback on new crypto regulations aimed at combating money laundering, terrorism financing, and fraud while enhancing consumer protection. The proposed eight-pillar framework includes stricter registration and reporting requirements for cryptocurrency exchanges, mandates compliance with the Financial Action Task Force’s Travel Rule, and involves collaboration with the Securities and Exchange Commission. Exchanges would need to register with the BoG and undergo sandbox testing before operating in Ghana. The BoG is accepting feedback until August 31 to shape the final regulations.

Reference: Cointelegraph

D. Macroeconomy

1. BRICS advances new payment system to rival SWIFT, with 159 countries ready to adopt

The BRICS alliance is pushing forward with its plan to create a new payment system designed to rival SWIFT and facilitate transactions without relying on the US dollar. This initiative, expected to launch in October, has generated significant interest, with 159 countries already expressing a readiness to adopt the system. The move reflects BRICS' broader strategy to reduce dependence on western financial infrastructure and promote the use of local currencies in international trade. The upcoming BRICS summit will prioritize this payment system, as it aims to enhance economic cooperation and streamline trade among member nations, while mitigating the impact of Western sanctions on economies like Russia's.

Reference: Watcher guru

2. U.S. unemployment claims drop to one-month low, easing rate cut hopes

New U.S. unemployment claims fell to a one-month low last week, signaling a managed slowdown in the labor market and reducing speculation about a potential 50 basis point Federal Reserve rate cut in September. Initial claims for state unemployment benefits decreased by 7,000 to a seasonally adjusted 227,000 for the week ending August 10, coming in below the 235,000 claims projected by economists. This decline follows a rise in late July attributed to temporary disruptions, including motor vehicle plant shutdowns and Hurricane Beryl's impact in Texas. The drop in claims, coupled with a notable 18-month high in retail sales for July, highlights the economy's underlying strength despite the recent uptick in the unemployment rate to 4.3%. Analysts suggest that the current data does not warrant a drastic rate cut, emphasizing that the labor market remains relatively stable with historically low layoffs. Businesses are primarily adjusting hiring rates rather than engaging in large-scale layoffs, as the effects of the Federal Reserve's substantial rate hikes in 2022 and 2023 continue to temper demand.

Reference: Reuters