Highlights of the Week- Issue #56

Preview

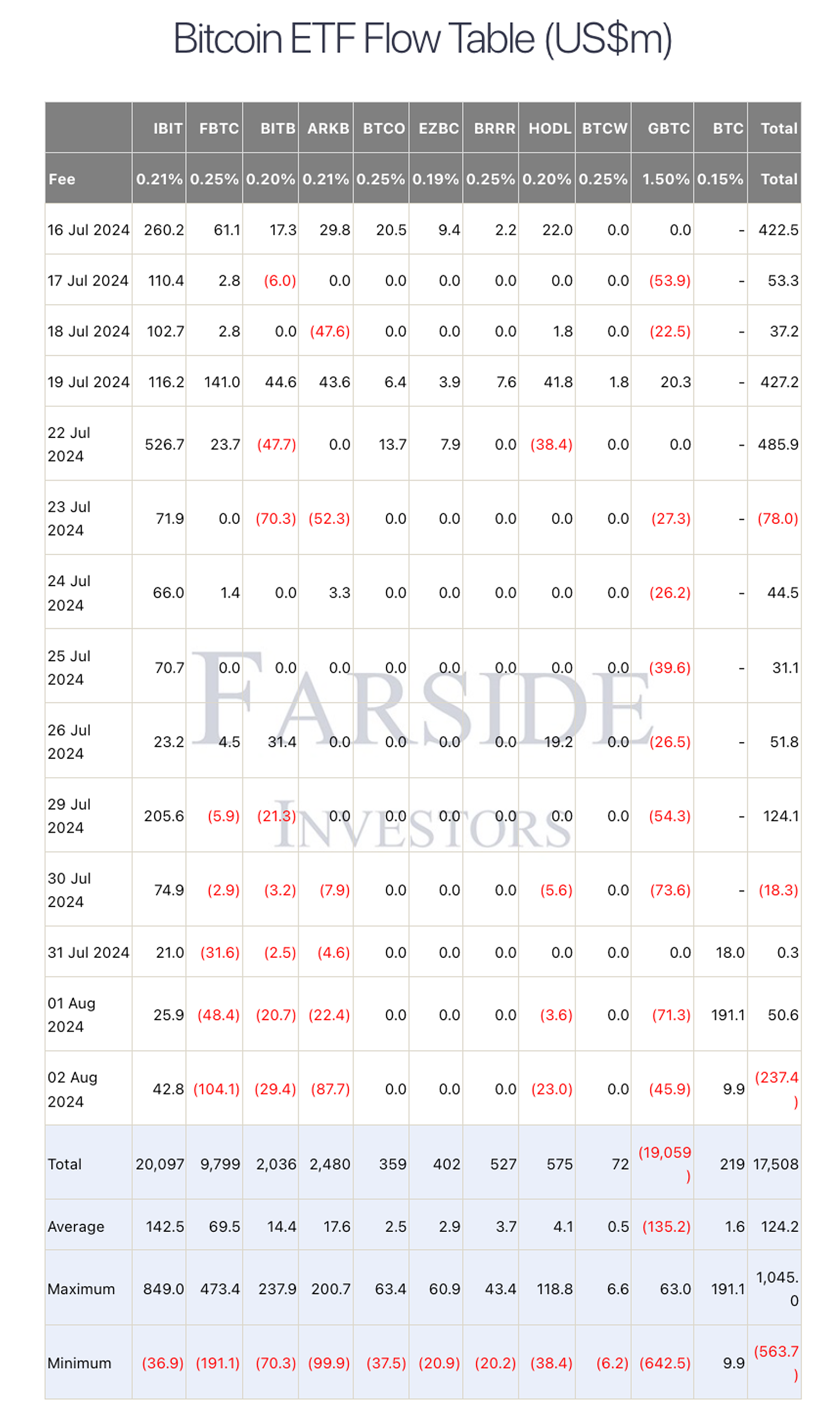

Last week, MicroStrategy introduced a new KPI, "Bitcoin Yield," targeting a 4%-8% annual range over the next three years. Morgan Stanley will begin recommending Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund, potentially leading to significant market inflows. The U.S. government, holding approximately $12 billion in Bitcoin, faces proposals to designate Bitcoin as a strategic reserve asset. Grayscale’s Bitcoin Mini Trust experienced $191 million inflow on its second day of trading. Genesis completed a $4 billion bankruptcy restructuring, with varied recovery rates for creditors. The University of Wyoming is set to launch a Bitcoin Research Institute to advance Bitcoin studies. Futu Securities in Hong Kong has introduced retail Bitcoin trading, becoming the first online broker in the region to offer direct access. Alby has launched Alby Hub, a simplified self-custodial lightning node application. In regulatory news, Russia has enacted a law allowing Bitcoin for international trade to circumvent sanctions, while the U.S. Fed held interest rates steady, while China's central bank reduced its loan rate to address slow economic growth and deflation. For more details, continue reading below.

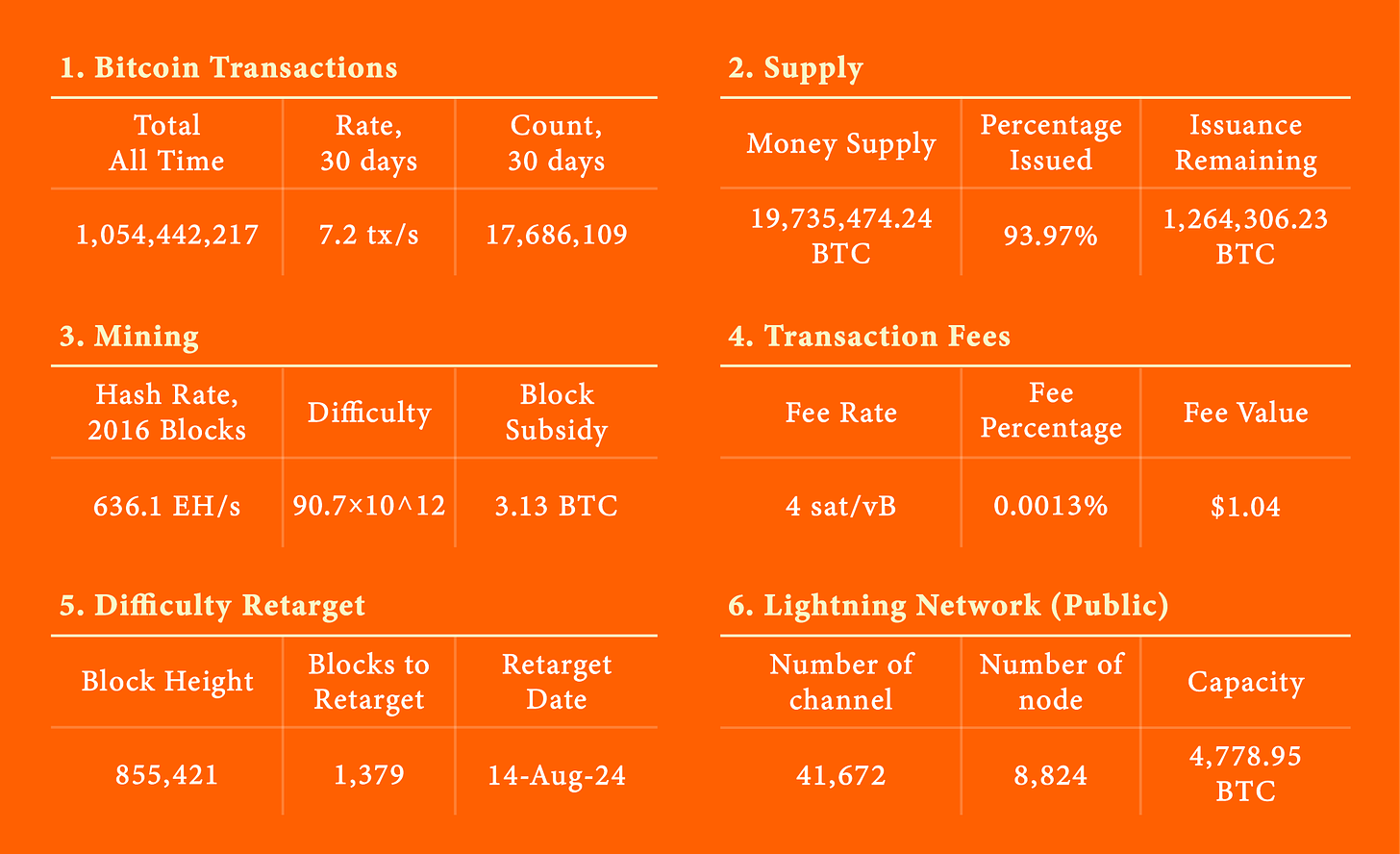

A. Bitcoin Data Dashboard

1. Bitcoin Transactions

2. Supply

3. Mining

4. Transaction Fees

5. Difficulty Retarget

6. Lightning Network (Public)

B. Bitcoin Ecosystem

1. MicroStrategy boosts Bitcoin holdings, introduces new Bitcoin Yield KPI

2. Morgan Stanley to start recommending Bitcoin ETFs, marking major milestone for Bitcoin adoption

3. U.S. Government holds $12 billion in Bitcoin, sparking proposals for strategic reserve asset

4. Grayscale’s Bitcoin Mini Trust surges with $191 million inflows on second day of trading

5. Genesis completes $4 billion bankruptcy restructuring, disburses funds to creditors

6. University of Wyoming to launch Bitcoin Research Institute

7. Futu Securities launches retail Bitcoin trading in Hong Kong

8. Alby launches Alby Hub: simplified self-custodial lightning node application

C. Regulation

1. Russia passes law allowing Bitcoin for international trade to circumvent sanctions

2. White House and crypto executives to discuss policy changes in private meeting

D. Macroeconomy

1. Fed keeps interest rates unchanged, signals potential rate cut amid cooling inflation

2. China's central bank cuts loan rate amid slow economic growth and deflation concerns

A. Bitcoin Data Dashboard

As of Aug 5. 2024

B. Bitcoin Ecosystem

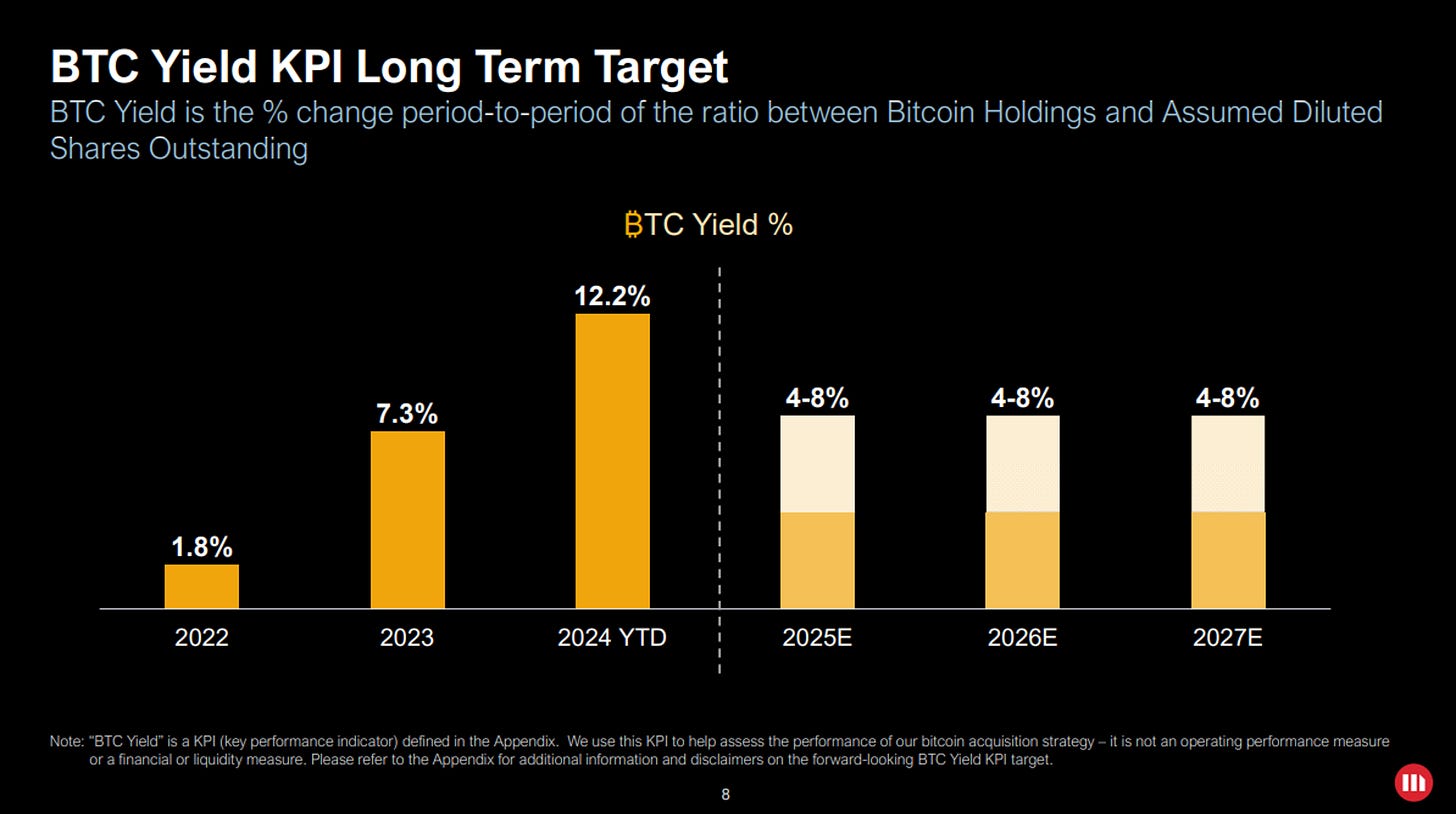

1. MicroStrategy boosts Bitcoin holdings, introduces new Bitcoin Yield KPI

In Q2 2024, MicroStrategy expanded its Bitcoin holdings by purchasing an additional 12,222 Bitcoin for $805 million, bringing its total to 226,500 BTC, worth around $14.7 billion at current prices. Despite this strategic investment, the firm's financial performance was challenging, with a reported loss of $5.74 per share on $111.4 million in revenue, a 7% decline year-over-year, exceeding analyst expectations of a $0.78 loss per share and $119.3 million in revenue. The company posted a net loss of $123 million, slightly better than the $137 million loss in Q2 2023.

MicroStrategy introduced a new key performance indicator (KPI) called "Bitcoin Yield," which measures the percentage change over time in the ratio between the firm’s Bitcoin holdings and its diluted outstanding shares. As of the year-to-date, the Bitcoin Yield stands at 12.2%, with a target range of 4%–8% annually over the next three years. This KPI is used to assess the performance of the company's Bitcoin acquisition strategy, which it believes benefits shareholders. Additionally, MicroStrategy confirmed a 10:1 stock split effective August 7 and announced plans to file for a $2 billion at-the-market equity offering to raise further capital.

Reference: Cryptoslate,Cointelegraph

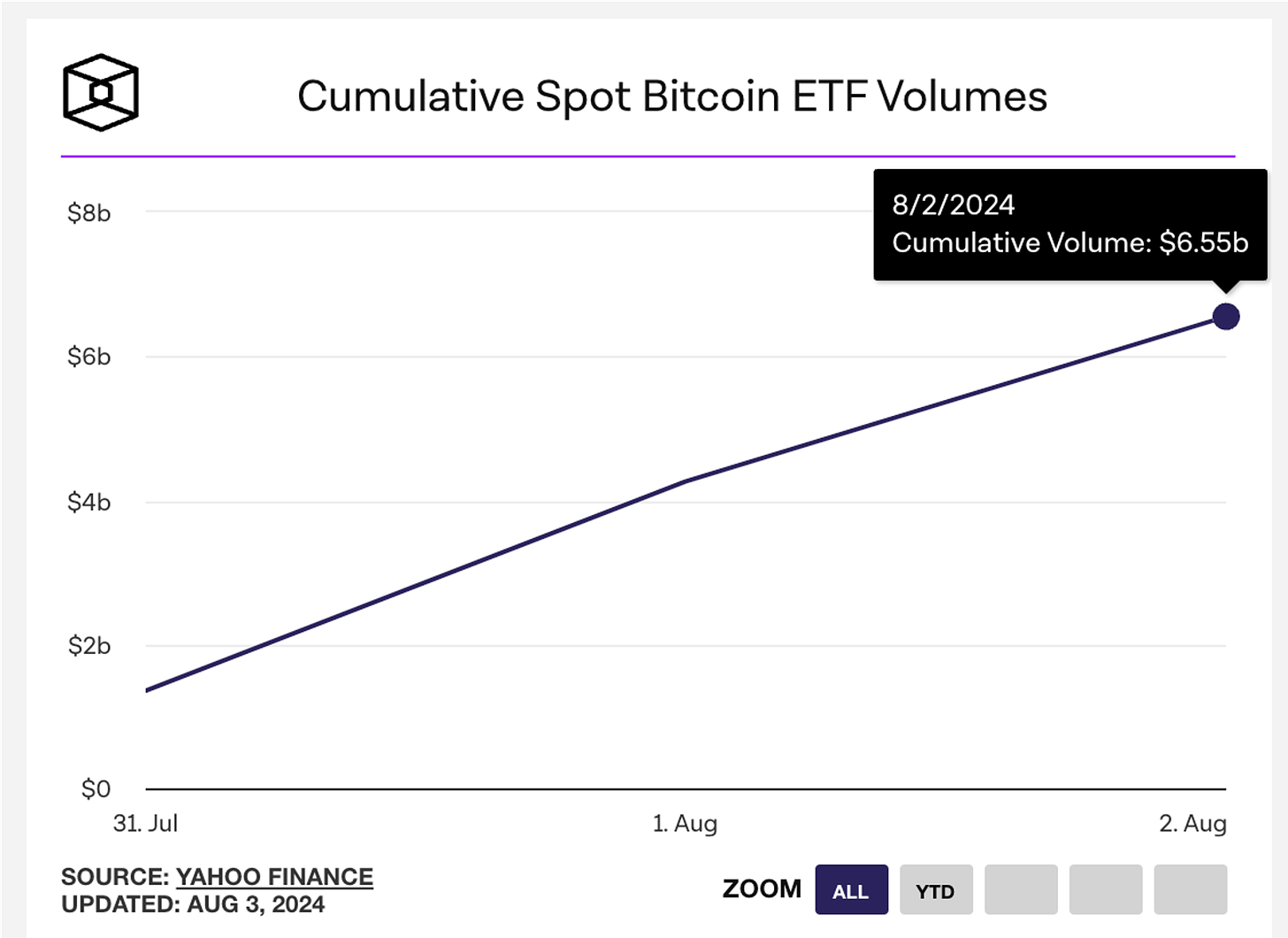

2. Morgan Stanley to start recommending Bitcoin ETFs, marking major milestone for Bitcoin adoption

Starting August 7, Morgan Stanley, the largest wealth manager in the U.S., will allow its 15,000 financial advisers to recommend Bitcoin ETFs to eligible clients, specifically BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC), according to CNBC. This move marks a significant milestone as major financial advisory firms, known as Bank of America, JPMorgan Chase, and Wells Fargo, have been hesitant to embrace spot bitcoin ETFs. Morgan Stanley's advisory network manages $3.75 trillion, and across all units, it handles $6.2 trillion, making its adoption of these ETFs a potential game changer for the bitcoin market. The endorsement by such a major financial player is expected to drive significant inflows into the bitcoin ETF market, further legitimizing and expanding its reach.

Reference: Cointelegraph,CNBC,The Block

3. U.S. Government holds $12 billion in Bitcoin, sparking proposals for strategic reserve asset

The U.S. government holds over 183,000 Bitcoin, valued at around $12 billion, making it the largest geopolitical owner of bitcoin. At the Bitcoin 2024 conference, Senator Cynthia Lummis proposed making Bitcoin a strategic reserve asset for the United States, suggesting that the government purchase 5% of Bitcoin’s total supply and hold it as a Treasury asset. Lummis argued that holding Bitcoin could provide a strategic advantage for the U.S. in the digital age, comparing her proposal to a modern "Louisiana Purchase." Former President Donald Trump and independent presidential candidate Robert F. Kennedy Jr. also expressed support for maintaining or expanding the U.S. government's Bitcoin holdings. Trump promised not to sell any of the government’s Bitcoin, emphasizing the need to support the Bitcoin industry and avoid stifling blockchain innovation with overregulation. Kennedy proposed an ambitious plan to buy 500 BTC per day until the U.S. owns 4 million BTC, further integrating Bitcoin into the nation's financial strategy. While candidate announcements are noteworthy, they are not sufficient to establish an official strategic reserve. Significant legal and institutional changes would be required to formalize Bitcoin as part of the U.S. strategic reserves.

Reference: Arkham,Cointelegraph

4. Grayscale’s Bitcoin Mini Trust surges with $191 million inflows on second day of trading

Grayscale’s Bitcoin Mini Trust (BTC) saw a significant boost, pulling in $191 million on its second day of trading, a 960% increase from the first day. Operating under the BTC ticker with a 0.15% sponsor fee. This new fund aims to reduce selling pressure on the Grayscale Bitcoin Trust (GBTC) and capture some of its capital outflows. Total net inflows for BTC reached $219 million, with its market value at $1.7 billion. Conversely on Aug 1st, GBTC saw $71 million in net outflows, with other competing ETFs also experiencing withdrawals. BlackRock’s Bitcoin ETF (IBIT) gained almost $26 million in net inflows, with US spot Bitcoin ETFs collectively taking in over $50 million.

Reference: Farside Investors,Investing.com

5. Genesis completes $4 billion bankruptcy restructuring, disburses funds to creditors

Genesis, an institutional lending platform that filed for bankruptcy in 2023, announced the completion of its Chapter 11 restructuring plan on August 2, disbursing approximately $4 billion to affected parties. Bitcoin creditors will receive 51.28% of their claims in BTC, Ether creditors 65.87% in ETH, and most altcoin creditors 87.65% of their assets, Solana creditors will only get 29.58% recovery. Stablecoin and cash creditors are eligible for 100% recovery in US dollars. Additionally, a $70 million litigation fund has been set up for further legal actions against third parties, including Genesis' parent company Digital Currency Group (DCG). The bankruptcy stemmed from the 2022 crypto contagion, where Genesis, borrowing from firms like Gemini and lending to entities like Three Arrows Capital, suffered significant losses. Genesis also settled with the SEC for $21 million over allegations of selling unregistered securities through the Gemini Earn program. SEC chief Gary Gensler emphasized the need for all cryptocurrency lending providers to comply with existing securities laws.

Reference: Cointelegraph

6. University of Wyoming to launch Bitcoin Research Institute

The University of Wyoming is set to launch the UW Bitcoin Research Institute in August, with the goal of producing high-quality, peer-reviewed studies on Bitcoin. Announced by Bitcoin activist and Associate Professor Bradley Rettler on July 28, the institute aims to address gaps in current Bitcoin research. Rettler has criticized existing studies, including a 2018 analysis on Bitcoin emissions, for inaccuracies and stressed the importance of rigorous academic work to guide public understanding and policy. The institute will officially open with the Fall 2024 semester and will feature annual workshops, academic prizes, and weekly seminars. Wyoming is increasingly recognized as a Bitcoin-friendly state, supported by pro-Bitcoin figures like Senator Cynthia Lummis and Caitlin Long, founder of Custodia Bank.

Reference: Bitcoin Magazine

7. Futu Securities launches retail Bitcoin trading in Hong Kong

Futu Securities, Hong Kong's largest online brokerage with over 3.5 million customers, has launched retail Bitcoin trading on its platform. Users can now buy and sell Bitcoin and Ether with Hong Kong or US dollars. This makes Futu the first online broker in Hong Kong to offer direct Bitcoin access to retail investors. Last month, Futu received approval from the Securities and Futures Commission (SFC) to provide virtual asset dealing services. The move follows Hong Kong's approval of a Bitcoin and Ethereum ETF earlier this year and new licensing regulations aimed at establishing the city as a crypto hub. Futu is also applying for a full Bitcoin and crypto exchange license for its PantherTrade platform, among the interim exchanges awaiting SFC approval. Futu is partnering with licensed exchange HashKey to ensure compliance with SFC rules. Futu's large client base and strong brand will likely drive significant retail Bitcoin trading volume in Hong Kong.

Reference: Finance Magnates

8. Alby launches Alby Hub: simplified self-custodial lightning node application

Alby has launched the waitlist for Alby Hub, a one-click install lightning node application designed to simplify self-custodial lightning use. Alby Hub includes a self-custodial Lightning wallet, an app store for connections to apps like Damus, Stacker News, podcast apps, and external lightning wallets. It supports easy migration from Alby’s web wallet. A Cloud plan is available for 21k satoshis per month, offering live channel management, setup support, and access to the Alby Buzz community. Alby Hub can also be installed on desktops, servers, or even a Raspberry Pi Zero. Alby Hub aims to reduce the friction of running a self-custodial lightning node, providing users with an easy way to manage their lightning funds. Founder Michael Bumann stated, “With Alby Hub, users have endless possibilities for self-sovereign payments on the web without the technical overhead.”

Reference: Bitcoin Magazine

C. Regulation

1. Russia passes law allowing Bitcoin for international trade to circumvent sanctions

Russian lawmakers have passed a bill allowing businesses to use Bitcoin and other cryptocurrencies for international trade, as reported by Reuters. This move, set to take effect in September, is aimed at mitigating the impact of Western sanctions imposed after Russia's invasion of Ukraine. The law is designed to address delays in international payments, especially with major trading partners like China, India, and the UAE. Central Bank Governor Elvira Nabiullina, who supports the law, announced that the first cryptocurrency transactions are expected by the end of the year. The central bank will create an "experimental" infrastructure for these payments. The legislation also regulates cryptocurrency mining and other digital assets but maintains a ban on cryptocurrency payments within Russia. Payment delays have led to an 8% drop in Russian imports in Q2 2024. Despite efforts to use alternative currencies and develop a BRICS payment system, many transactions still rely on dollars and euros, risking secondary sanctions. Sanctions have complicated import payments, extending supply chains and increasing costs. The new law aims to ease these economic challenges and improve international trade.

Reference: Reuters

2. White House and crypto executives to discuss policy changes in private meeting

Crypto executives are set to meet privately next week with White House aides and Democratic Representative Ro Khanna to address policy issues. Bloomberg reports the roundtable will include top officials from Vice President Kamala Harris’s campaign and the White House, including Anita Dunn, Lael Brainard, and Bruce Reed. This engagement signals the administration's willingness to address the crypto sector's concerns. The meeting follows a similar roundtable in July with major firms. With 50 million Americans invested in digital assets, presidential candidates, including Donald Trump, are vying for crypto-focused voter support.

Reference: Cointelegraph

D. Macroeconomy

1. Fed keeps interest rates unchanged, signals potential rate cut amid cooling inflation

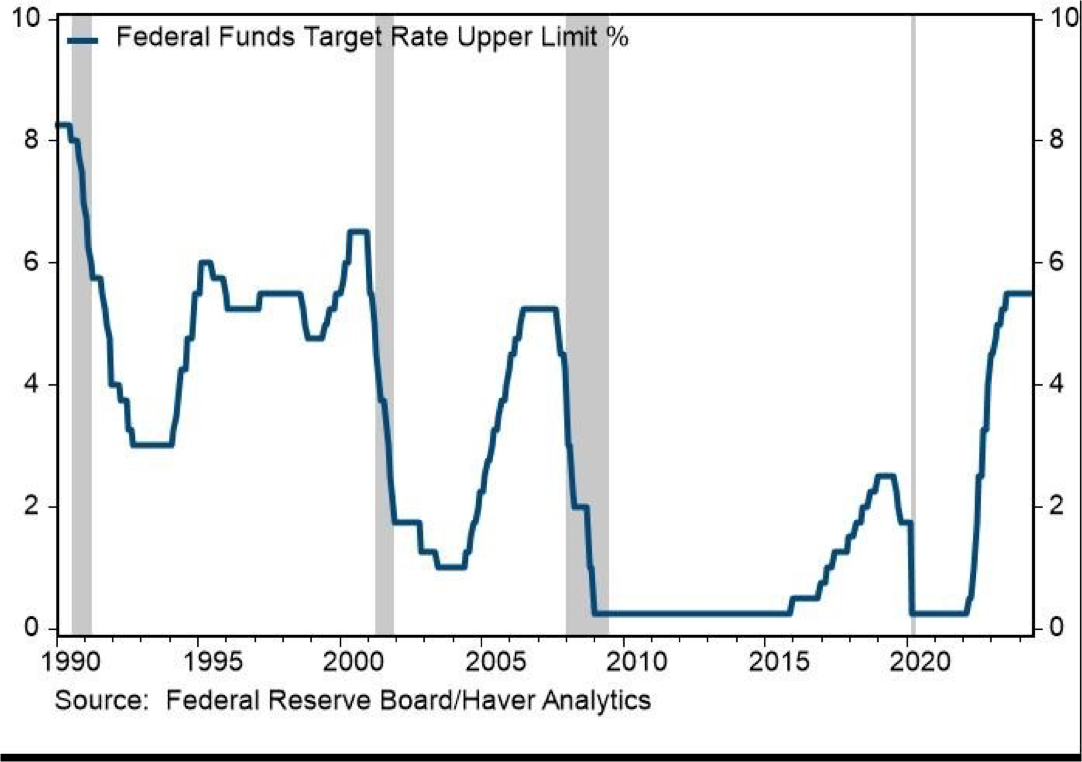

The US Federal Reserve announced its interest rate decision on July 31 after a two-day Federal Open Market Committee (FOMC) meeting, leaving the benchmark interest rates unchanged at 5.25% - 5.50% for the eighth straight meeting. The US central bank has maintained steady borrowing rates for 12 months to reduce inflation in the world's largest economy. On Wednesday, Powell set the stage for the Fed's first rate cut in four years, citing progress toward lower inflation and a cooler job market that no longer threatens to overheat the economy. Powell said if US inflation continues to fall, "a reduction in our policy rate could be on the table" when the Fed next meets in September."The broad sense of the committee is that the economy is moving closer to the point at which it will be appropriate to reduce our policy rate," he said, adding that there had been a "really significant decline in inflation, but we’re not quite at that point." The Fed's policy statement noted that US inflation has eased over the past year but "remains somewhat elevated." After raising the policy rate by 5.25 percentage points since March 2022 to combat the worst inflation outbreak in 40 years, the central bank has held the rate steady since July 2023 to anchor high inflation and consistently bring it down toward the 2% target range.

Reference: Livemint

2. China's central bank cuts loan rate amid slow economic growth and deflation concerns

China's central bank, the People's Bank of China (PBOC), recently cut its one-year loan rate by 10 basis points, the first reduction in two and a half years. Since late 2021, the PBOC has only cut this rate by a total of 50 basis points. This latest rate cut comes amid slower-than-expected economic growth, with weak domestic demand contributing to deflationary pressure. Despite periodic rate cuts over the past decade to boost credit, these efforts have not revitalized the economy. Analysts call for more fiscal and regulatory policies to stimulate demand. Concerns about excessive rate cuts affecting the currency value have led to cautious monetary policy. A weaker renminbi could complicate servicing foreign debts and invite protectionist measures from trading partners like the United States. In response to these challenges, the PBOC also cut a key interest rate by 20 basis points and provided US$27.5 billion in new loans at the new rate. The Chinese government announced US$41.5 billion in subsidies for households to purchase automobiles and consumer electronics, funded by special purpose bonds, aiming to boost consumption and counteract deflationary pressures.

Reference: Delloite Insights