Highlights of the Week- Issue #55

Preview

Last week at the Bitcoin 2024 conference, Donald Trump pledged to make the U.S. the Bitcoin Superpower Nation if elected, stating never sell your bitcoin, Edward Snowden warned against politicizing Bitcoin. Senator Cynthia Lummis introduced a plan for a strategic Bitcoin reserve to combat inflation and strengthen the dollar. Michigan's state pension fund invested $6.6 million in the ARK 21Shares Bitcoin ETF. Unbound Fund offers Bitcoin holders EU citizenship via Portugal’s golden visa program with a €500,000 investment. The SEC approved Grayscale's Bitcoin Mini Trust for NYSE Arca listing, featuring lower fees. Ferrari is expanding its cryptocurrency payment system to Europe after a successful U.S. launch. Latvia's new crypto regulation aims to boost digital innovation. For more details, continue reading below.

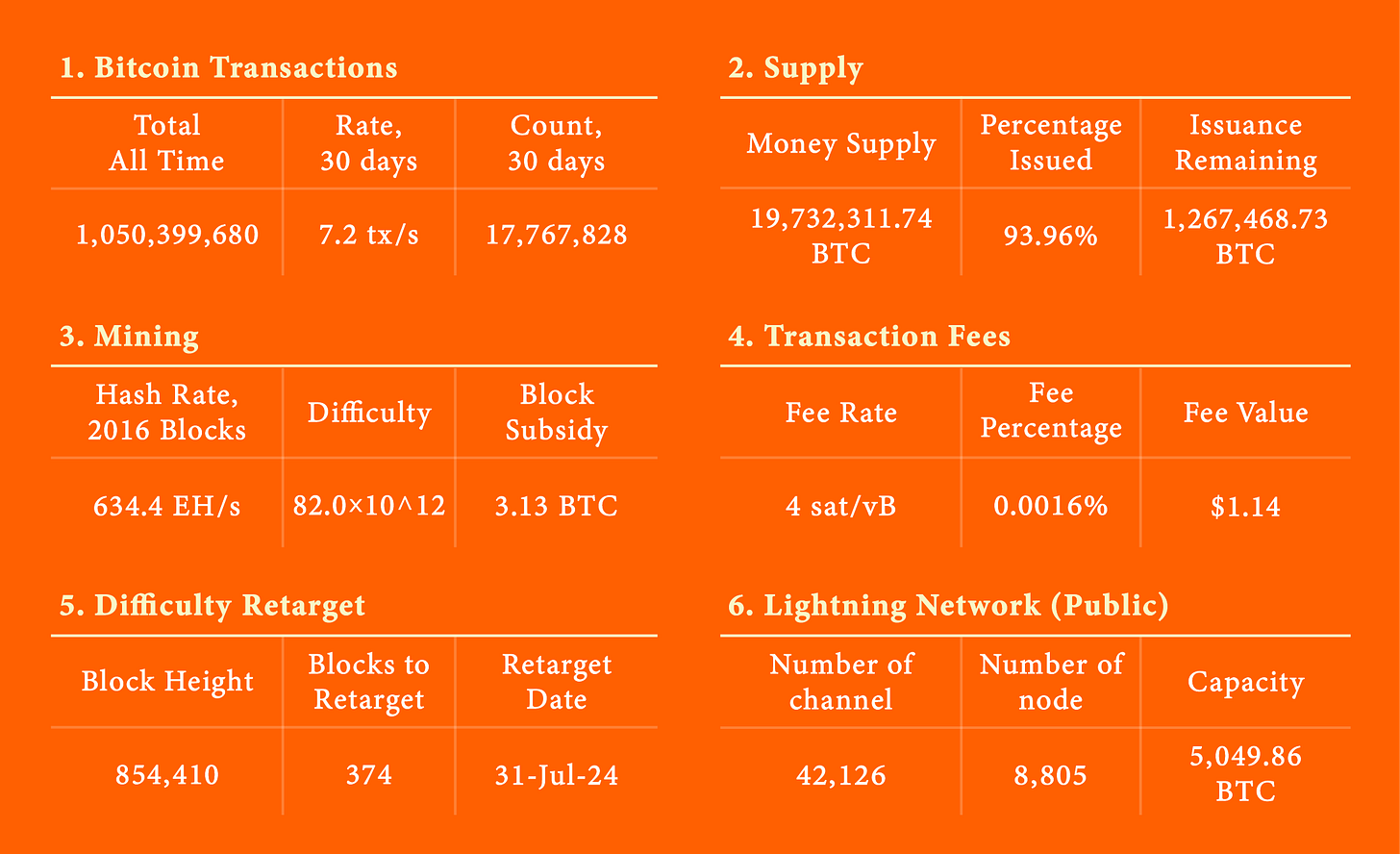

A. Bitcoin Data Dashboard

1. Bitcoin Transactions

2. Supply

3. Mining

4. Transaction Fees

5. Difficulty Retarget

6. Lightning Network (Public)

B. Bitcoin Ecosystem

1. Trump vows to make America the Bitcoin Superpower Nation at Bitcoin 2024 conference

2. Senator Cynthia Lummis proposes strategic bitcoin reserve to fortify U.S. dollar and combat inflation

3. Michigan State pension fund invests $6.6 million in ARK 21Shares Bitcoin ETF

4. New fund offers bitcoin holders path to EU citizenship through Portugal's Golden Visa program

5. SEC approves Grayscale's Bitcoin Mini Trust for NYSE Arca listing

6. Ferrari expands cryptocurrency payment system to Europe following US success

C. Regulation

1. Latvia pioneers digital innovation with new crypto regulation

2. Swiss regulator FINMA issues guidance on stablecoins, highlighting money laundering and reputational risks

D. Macroeconomy

1. Treasury’s quarterly refunding and Fed actions set to influence future liquidity trends

2. Chinese economic slowdown spurs calls for stimulus

A. Bitcoin Data Dashboard

As of July 29. 2024

B. Bitcoin Ecosystem

1. Trump vows to make America the Bitcoin Superpower Nation at Bitcoin 2024 conference

At the Bitcoin 2024 conference in Nashville, Tennessee, former U.S. President and current Republican candidate Donald Trump announced his intent to make the United States the Bitcoin Superpower Nation of the world if elected in November. After taking the stage an hour late, Trump expressed great respect for the Bitcoin community, likening its potential to the early steel industry. He predicted that Bitcoin would eventually overtake gold, praising it as a marvel of technology and a miracle of human cooperation. Trump stated to "never sell your bitcoin". Trump then Emphasizing his support for the crypto community, declared he would be the best candidate for Bitcoin enthusiasts and stressed the importance of America leading in bitcoin. In addition, Independent candidate Robert F. Kennedy Jr. unveiled a bold Bitcoin policy, proposing executive orders to create a strategic reserve and accumulate significant Bitcoin holdings for the U.S. government. Edward Snowden, also speaking at the conference, cautioned against politicians using Bitcoin as a political tool, urging the community to remain vigilant and independent.

Reference: Cointelegraph, NewYork Times

2. Senator Cynthia Lummis proposes strategic bitcoin reserve to fortify U.S. dollar and combat inflation

U.S. Senator Cynthia Lummis (R-WY) unveiled a proposal to create a strategic Bitcoin reserve aimed at fortifying the U.S. dollar against inflation and cementing America's leadership in the evolving global financial landscape. Lummis stated that establishing this reserve would secure the dollar's position as the world’s reserve currency into the 21st century and ensure the U.S. remains a leader in financial innovation. She highlighted the struggles of American families facing soaring inflation and unprecedented national debt levels, advocating for diversifying into Bitcoin to create a brighter economic future. The proposal involves setting up a decentralized network of secure Bitcoin vaults managed by the Treasury Department, with statutory requirements ensuring top-notch physical and cybersecurity. It includes a program to purchase one million Bitcoins over time, acquiring roughly 5% of the total Bitcoin supply, akin to the scale of U.S. gold reserves. The initiative would be funded by reallocating existing Federal Reserve and Treasury resources. The strategic Bitcoin reserve would hold these assets for 20 years, solely for paying down national debt, thereby reinforcing the nation's economic stability. Additionally, the legislation affirms the self-custody rights of private Bitcoin holders and guarantees that the strategic reserve will not infringe upon individual financial freedoms. Lummis's bill, expected to be introduced soon, aims to secure the U.S. financial standing for decades, with more cosponsors to be announced.

Reference: Lummis. Senate.gov

3. Michigan State pension fund invests $6.6 million in ARK 21Shares Bitcoin ETF

According to a June 30 filing with the U.S. Securities and Exchange Commission, Michigan’s state pension fund holds 110,000 shares of the ARK 21Shares Bitcoin ETF, ticker ARKB, valued at approximately $6.6 million at the time of filing. This makes Michigan the third U.S. state to allocate part of its pension fund to crypto through ETFs since Bitcoin ETFs were approved in January. In May, the State of Wisconsin Investment Board reported a $164 million investment in spot Bitcoin ETFs from Grayscale and BlackRock. On July 25, Jersey City Mayor Steven Fulop hinted at a 2% investment in Bitcoin ETFs by the city’s pension fund.

Reference: Cointelegraph

4. New fund offers bitcoin holders path to EU citizenship through Portugal's Golden Visa program

A new fund offers Bitcoin holders a path to EU citizenship via Portugal’s golden visa program. Alessandro Palombo, co-founder and CEO of Unbound Fund, announced on X that their fund allows investors to gain Portuguese citizenship by investing in Bitcoin. Palombo claims their fund is the first to qualify for the Portuguese golden visa program by providing BTC exposure. Investors holding Bitcoin worth 500,000 euros ($542,000) indirectly through the fund will qualify for the Portugal Golden Residence Permit Program, a five-year residence-by-investment initiative for non-EU nationals. The fund focuses on companies with 100% passive Bitcoin holdings and also invests in BlackRock ETFs for security and simplicity. Palombo emphasized the importance of using Bitcoin for freedom of movement, particularly in Portugal, where he resides with his family. He believes the European citizen-by-investment program is the best for technical and strategic reasons and noted that they have already onboarded customers and are in discussions with complementary teams.

Reference: Cointelegraph

5. SEC approves Grayscale's Bitcoin Mini Trust for NYSE Arca listing

The SEC has approved Grayscale’s new spot Bitcoin ETF, the Grayscale Bitcoin Mini Trust (BTC), for listing on the NYSE Arca platform on Friday. This marks a significant milestone for Grayscale, which plans to spin off part of its flagship Bitcoin fund, Grayscale Bitcoin Trust (GBTC), into the Mini Trust. The Mini Trust features management fees of 0.15%, significantly lower than GBTC's 1.5%, making it a more cost-effective option for investors. On July 31, Grayscale will transfer 10% of GBTC's spot Bitcoin holdings to the Mini Trust. Existing GBTC shareholders will receive shares in the Mini Trust proportional to their GBTC holdings, ensuring they maintain their total spot BTC exposure across the two funds. This move offers shareholders a tax-advantaged way to transition to the new ETF. Grayscale has made similar moves with its Ethereum Trust, further expanding its range of investment products in the cryptocurrency market.

Reference: The Block

6. Ferrari expands cryptocurrency payment system to Europe following US success

Ferrari, the Italian luxury sports car maker, is set to expand its cryptocurrency payment system to Europe after a successful launch in the United States. Starting at the end of July 2024, Ferrari will roll out crypto payments to its European dealer network. By the end of the year, the company plans to extend this feature to other countries where cryptocurrencies are legally accepted. This follows the successful launch of the crypto payment system in the US in October 2023, in partnership with BitPay. Ferrari's crypto payment tools convert cryptocurrencies like Bitcoin, Ether, and USDC into fiat currencies, allowing dealers to receive payments directly in local currency without managing cryptocurrencies themselves. Currently, around 60% of Ferrari's European dealers have adopted or are in the process of adopting the new payment system

Reference: Reuter

C. Regulation

1. Latvia pioneers digital innovation with new crypto regulation

Latvia is making significant strides in digital innovation. In June, Latvian regulators advanced the “Crypto Asset Services Law,” aiming to create a clear regulatory framework to boost growth and attract investment in cryptocurrency enterprises. Minister of Economics Viktors Valainis shared that the law provides essential legal clarity, potentially stimulating economic activity by up to 25% and increasing the labor force in the sector. Latvia plans to enable tax payments and company equity contributions with crypto assets, enhancing business operations. Despite a reported 50% decline in crypto asset investment due to past fraud and insolvency incidents, the Bank of Latvia is working to reverse this trend by supporting projects through its “Innovation Hub.” A strategic partnership between Magnetiq Bank underscores Latvia's commitment to high-tech investments and innovation. Valainis detailed initiatives to attract Web3 businesses, including substantial financial support for digitalization and innovation, with aims to double the economy by 2035. Key projects include enabling tax payments with crypto and establishing a National Artificial Intelligence Center. As digital transformation accelerates globally, Latvia is positioning itself as a leader in embracing and driving this innovation.

Reference: Cointelegraph

2. Swiss regulator FINMA issues guidance on stablecoins, highlighting money laundering and reputational risks

The Swiss Financial Market Supervisory Authority (FINMA) has issued new guidance on stablecoins, emphasizing the increased risks of money laundering and reputational harm to the Swiss financial sector. Published on July 26, the guidance recommends classifying stablecoin issuers as financial intermediaries to mitigate these risks. This classification would require issuers to verify the identity of stablecoin holders and establish the identity of beneficial owners under anti-money laundering laws. FINMA also addressed the use of default guarantees by Swiss stablecoin issuers, which allows them to operate without a banking license. The regulator insists on a framework to protect depositors, requiring issuers to inform customers of default guarantees and ensure that claims are due at the time of insolvency. While acknowledging that this protection does not match that of a banking license, FINMA remains committed to mitigating risks associated with stablecoins and default guarantees.

Reference: Bitcoin.com

D. Macroeconomy

1. Treasury’s quarterly refunding and Fed actions set to influence future liquidity trends

Domestic liquidity indicators are stable. The Federal Reserve's quantitative tightening negatively impacts liquidity, while the Treasury's slight reduction of its cash balance at the Fed is a positive factor. Reverse repos are neutral. The Treasury Department’s quarterly refunding announcement at the end of this month is crucial. With deficit spending exceeding estimates, higher borrowing plans are likely potentially shifting more debt issuance toward T-bills, enhancing liquidity by drawing capital from the Fed’s $380 billion reverse repo facility back into the financial system. U.S. bank reserves are over $3.3 trillion, up from $3.0 trillion in March 2023, due to faster reverse repo facility drain compared to the Fed's reserve reduction. The Fed's floor for reserves is likely higher than the $3.0 trillion seen in Spring 2023. Larger banks have comfortable cash liquidity, while smaller banks are near the bottom of their post global financial crisis range. Global liquidity metrics are stable, with the dollar-denominated global money supply consolidating rather than posing issues as in 2022. Domestic liquidity is expected to remain flat for the next several months. By 2025, a pivot toward higher liquidity is likely as the Fed ends quantitative tightening. Mild interest rate cuts in late 2024 and early 2025 could further enhance global liquidity by reducing dollar strength.

Reference: Lyn Alden

2. Chinese economic slowdown spurs calls for stimulus

China's economy continues to slow, as indicated by recent data released. The weak demand amid strong output growth has increased pressure on the government to stimulate domestic consumption rather than relying on exports, especially with potential trade restrictions from the US and EU looming. In Q2 2024, China's real GDP grew by 4.7% year-over-year, down from 5.3% in Q1, marking the slowest growth since Q1 2023. Retail sales in June rose only 2% from a year earlier, the weakest increase since December 2022, driven by declining property values and a weak labor market. Meanwhile, industrial production in June increased by 5.3% year-over-year, with significant growth in chemicals, non-ferrous metals, and transportation equipment. Fixed asset investment grew by 3.9% in the first half of 2024, driven mainly by government-funded infrastructure projects, while private sector investment stagnated. The property market remains in crisis, with new home prices falling in most major cities. As domestic demand remains weak, the government faces debates on the best economic policies to adopt moving forward.

Reference: Delloite insights, Trading economics