Preview

Last week, former president Trump advocating Bitcoin, aiming for U.S. leadership in bitcoin over China. Bitcoin's resilience was underscored by its performance during the recent CrowdStrike blackout. Investor Mark Cuban speculated that geopolitical instability and inflation could elevate Bitcoin to global reserve status. Crypto exchange Kraken received significant Bitcoin transfers from the Mt. Gox Rehabilitation Trustee for distribution to creditors. Bitcoin's hashrate drop to December 2022 levels raised miner capitulation concerns. Grayscale is launching lower-fee ETFs for their Bitcoin and EthereumTrusts. Bankrupt crypto lender BlockFi announced interim crypto distributions via Coinbase as part of their debt settlement plan. For more details, continue reading below.

A. Bitcoin Data Dashboard

1. Bitcoin Transactions

2. Supply

3. Mining

4. Transaction Fees

5. Difficulty Retarget

6. Lightning Network (Public)

B. Bitcoin Ecosystem

1. Trump aims for U.S. leadership in bitcoin, game theory impacts presidency and geopolitics

2. Bitcoin's antifragile nature shines amidst CrowdStrike blackout and global disruptions

3. Mark Cuban predicts geopolitical instability and inflation could propel Bitcoin to global reserve status

4. Kraken receives Bitcoin and Bitcoin Cash transfers from Mt. Gox trustee

5. Bitcoin hashrate drops to December 2022 levels, raising miner capitulation concerns

6. Grayscale to launch lower-fee spinoffs of Bitcoin and Ethereum Trusts

7. BlockFi to begin crypto distributions via Coinbase amid bankruptcy repayment plan

C. Regulation

1. EU regulators release guidelines under MiCA regulation

2. U.S. Court allows Binance.US to invest customer funds in treasury bills

D. Macroeconomy

1. U.S. inflation slows in June, boosting odds of September Fed rate cut

2. Japan GDP growth forecast downgraded amid mixed economic data

A. Bitcoin Data Dashboard

As of July 22. 2024

B. Bitcoin Ecosystem

1. Trump aims for U.S. leadership in bitcoin, game theory impacts presidency and geopolitics

Former U.S. President Donald Trump has become a vocal supporter of Bitcoin during his election campaign. In a recent interview with Bloomberg Businessweek, Trump asserted that Bitcoin is "not going away" and expressed his desire for the U.S. to lead in Bitcoin and crypto innovation before China or any other country. This embrace of Bitcoin represents a major shift for Trump, who began accepting Bitcoin lightning donations during his 2024 campaign. "My experience with it has been amazing," Trump said. "I've seen how it works. It's been really eye-opening." Trump cited China's status in Bitcoin and crypto as a key reason the U.S. must secure a leading position. "China is very much into it. If we don't do it, China is going to pick it up," he said. "I don't want to be responsible for allowing another country to take over this sphere." The former president wants Bitcoin mining to thrive in America, stating, "We want all the remaining Bitcoin to be mined in the USA." He also opposes a digital dollar, arguing it would "take away the importance of the dollar." With Bitcoin supporter J.D. Vance now his running mate, Trump seems intent on making Bitcoin and crypto a signature issue. He is still scheduled to give a keynote speech at the upcoming Bitcoin 2024 conference in Nashville, despite the recent assassination attempt. Trump has weighing JP Morgan's CEO Jamie Dimon for US Treasury and intends to leave Federal Reserve Chair Jerome Powell in place. Trump's embrace of Bitcoin indicates how far the bitcoin has come in gaining mainstream acceptance and highlights the competitive dynamics between countries. However, his recent statement accusing El Salvador of sending criminals to the U.S. is causing concern among Latin American voters and has impacted perceptions among Bitcoin supporters regarding Trump's chances of regaining the presidency.

Reference: Bitcoin magazine, Cointelegraph

2. Bitcoin's antifragile nature shines amidst CrowdStrike blackout and global disruptions

The recent CrowdStrike blackout has underscored Bitcoin's antifragile nature amidst systemic disruptions. While CrowdStrike, a leading cybersecurity firm, experienced significant operational interruptions that impacted global flight operations, online banking services, and broadcasting networks, Bitcoin's decentralized and resilient architecture highlighted its capacity to withstand such vulnerabilities. Unlike these centralized systems, Bitcoin’s decentralized network, which lacks a single point of control, remains functional and secure despite disruptions. Its widespread adoption and the capability for anyone to run its open-source software from anywhere enhance its robustness. As Bitcoin's network grows and becomes increasingly decentralized, its resilience strengthens, reinforcing its role as a reliable and enduring asset amid technological and geopolitical uncertainties.

Reference: Odysseycs

3. Mark Cuban predicts geopolitical instability and inflation could propel Bitcoin to global reserve status

Entrepreneur and investor Mark Cuban recently speculated that geopolitical instability and inflationary pressures might propel Bitcoin to become a global reserve asset. Cuban noted that Silicon Valley's support for former President Trump could indicate a “Bitcoin play” from Big Tech. He highlighted that the U.S.'s geopolitical role is being questioned and that future tax cuts could worsen inflation. These factors, Cuban suggested, could drive Bitcoin's price higher, though he clarified he wasn’t predicting this outcome. Fiat currencies, including the US dollar, suffer from inflationary printing.

Reference: Cointelegraph

4. Kraken receives Bitcoin and Bitcoin Cash transfers from Mt. Gox trustee

Crypto exchange Kraken has received Bitcoin and Bitcoin Cash transfers from the Mt. Gox Rehabilitation Trustee. In an email to clients, Kraken confirmed the receipt of creditor funds and indicated a distribution timeframe of 7-14 days. The amount received by each creditor will follow the Trustee's instructions. On July 16th, a Mt. Gox wallet transferred approximately 48,641 BTC ($3.1 billion) to an unlabeled address, identified by blockchain analytics platform Arkham as likely associated with Kraken. These funds remain unspent. Rehabilitation Trustee Nobuaki Kobayashi announced that over 13,000 creditors have received repayments in Bitcoin and Bitcoin Cash to date. He asked eligible creditors to be patient. Previously, Japanese exchanges Bitbank and SBI VC Trade distributed their allocated funds within hours. Other firms selected for creditor distributions, including BitGo, Bitstamp, and Kraken, have varying payout deadlines.

Reference: The Block

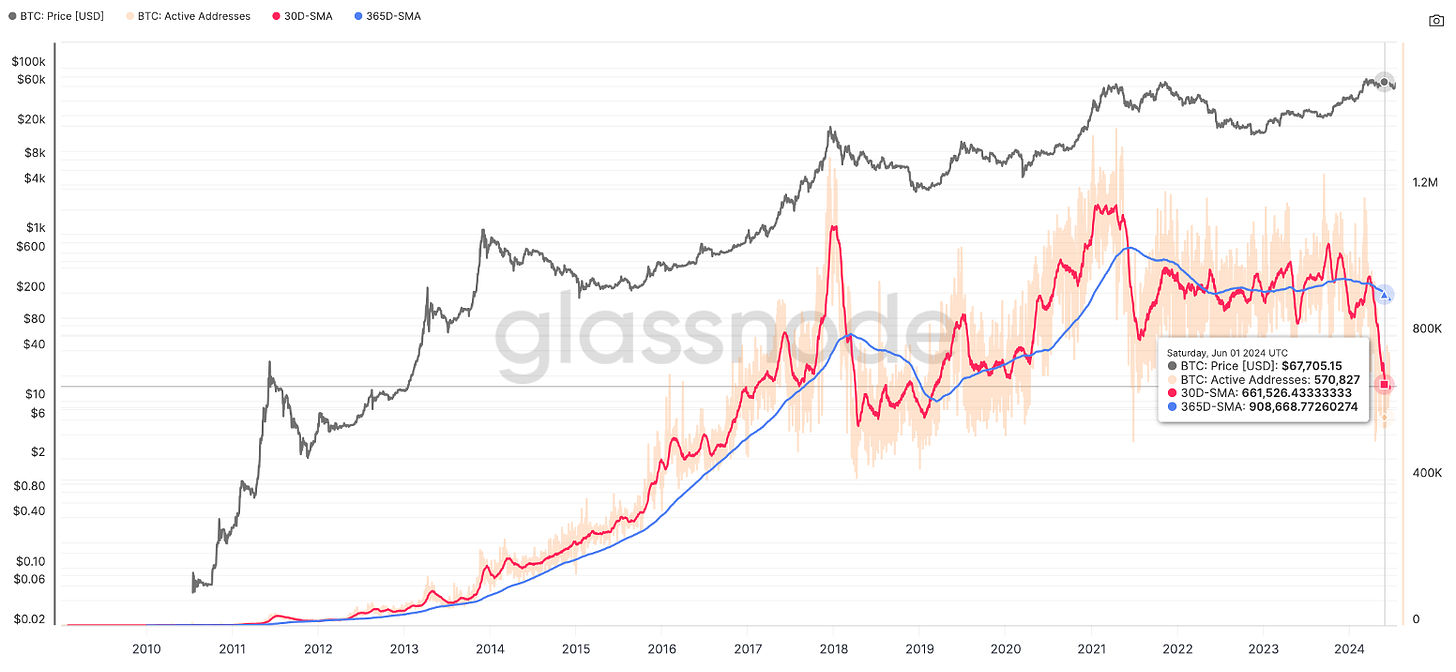

5. Bitcoin hashrate drops to December 2022 levels, raising miner capitulation concerns

In early July, Bitcoin's hashrate, a measure of the network's computing power, dropped to levels not seen since December 2022, indicating potential miner capitulation. This follows Bitcoin's fourth halving in April, which cut block rewards to 3.125 BTC, reducing miner revenue. The market is facing declining on-chain activity and the cooling of trends like Runes and Ordinals. Mining also seen a trend of becoming more centralized, with corporate entities entering the space even though decentralized mining pools has been adopted. While the hashrate drop could signal a price bottom, the network's security remains robust, with low selling pressure from miners. Historical data seems to suggest that Bitcoin’s price and hashrate are somewhat correlated, as both have been rising in tandem for the better part of the last decade as bitcoin adoption exploded. A falling hashrate, however, could also point to falling prices. Popular Bitcoin proponent Max Keiser has famously said that “price followers hashrate” to back his bullish BTC price predictions.

Reference: Glassnode, Cointelegraph

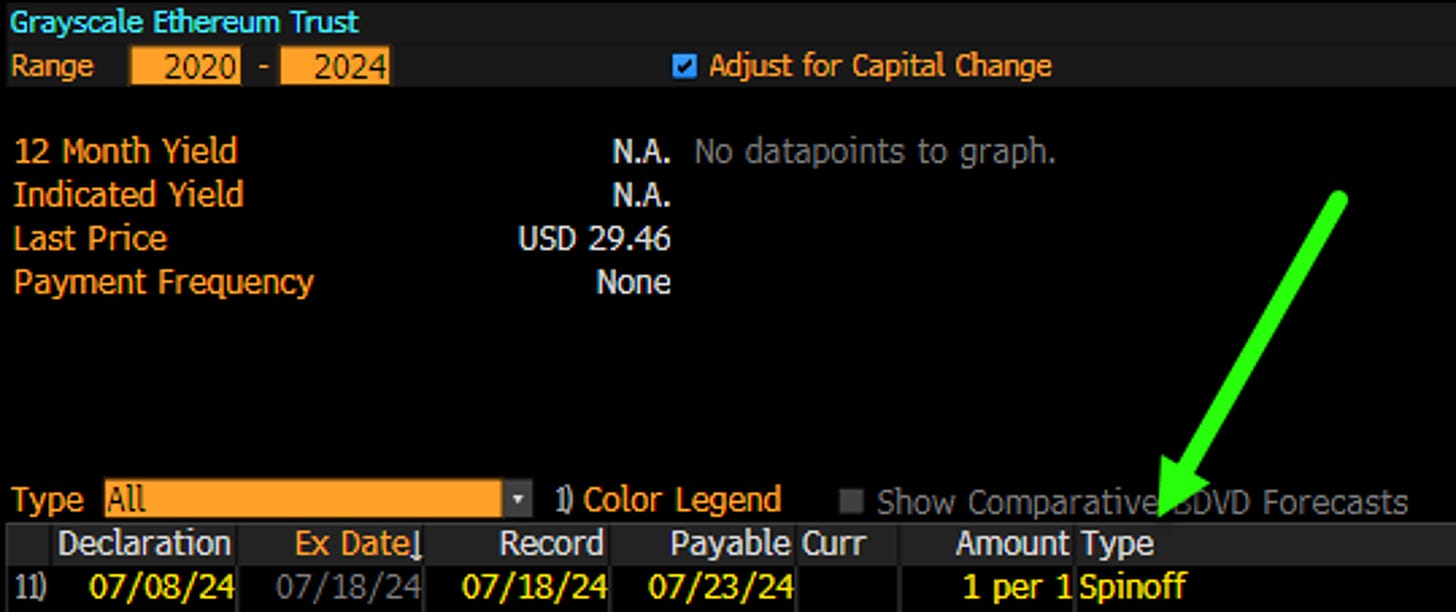

6. Grayscale to launch lower-fee spinoffs of Bitcoin and Ethereum Trusts

Grayscale Investments is launching spinoffs of their Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE) into new ETFs: Grayscale Bitcoin Mini Trust (BTC) and Grayscale Ethereum Mini Trust (ETH) . Bloomberg analyst James Seyffart explained that these spinoffs will follow a 90-10% sharing format, where if you own 1,000 shares of ETHE or GBTC, you'll receive 1,000 shares of ETH or BTC. The value of the original shares will decrease by 10%, with the new shares making up the difference. The spinoff for ETHE is scheduled for July 23 and GBTC for July 31. Investors must purchase shares before the record dates (July 18 for ETHE and July 30 for GBTC) to be eligible. Grayscale aims to offer these new ETFs at lower fees, with the ETH spinoff carrying a sponsor fee of 0.15%, compared to ETHE's 2.5%.

Reference: Mitrade,X.com,Cointelegraph

7. BlockFi to begin crypto distributions via Coinbase amid bankruptcy repayment plan

Bankrupt crypto lender BlockFi announced it will begin interim crypto distributions through Coinbase this month. These distributions will be processed in batches over the coming months, and eligible clients will be notified via the email associated with their BlockFi account. Due to regulatory restrictions, non-US clients are currently excluded from receiving funds. After FTX's collapse in November 2022, BlockFi entered bankruptcy proceedings, shut down its web platform, and partnered with Coinbase to enable clients to access and withdraw their funds. In September 2023, BlockFi’s Chapter 11 repayment plan was approved, targeting debt settlements with approximately 10,000 creditors. The company owes $1 billion to its three largest creditors and $220 million to the bankrupt crypto hedge fund Three Arrows Capital. BlockFi also reached an $875 million settlement in March 2024 with the estates of FTX and Alameda Research, resolving claims against FTX and leading to FTX dropping millions of dollars in counterclaims against BlockFi.

Reference: Cointelegraph

C. Regulation

1. EU regulators release guidelines under MiCA regulation

Regulators in the European Union have issued new guidelines allowing relevant market participants to classify cryptocurrencies and digital assets under the Markets in Crypto-Assets (MiCA) Regulation. On July 12, the European Banking Authority, European Insurance and Occupational Pensions Authority, and European Securities and Markets Authority released a consultation paper to standardize and clarify digital asset classification across the region. The guidelines provide a structured approach to classifying crypto assets, determining their classification through question-based prompts about the issuer, blockchain basis, or financial instrument type. The first MiCA regulations, effective June 30, with the next set expected by December 2024.

Reference: Cointelegraph

2. U.S. Court allows Binance.US to invest customer funds in treasury bills

On July 19, a U.S. court granted Binance.US permission to invest customer funds in U.S. Treasury Bills. The U.S. District Court for the District of Columbia's order permits Binance.US to allocate certain' customer funds through a third-party investment manager, provided these funds are not reinvested in Binance.US or its affiliates. The court also mandates that Binance.US include data on the costs associated with maintaining these investments in its monthly business expense reports. This ruling underscores the growing intersection of cryptocurrency and traditional finance, suggesting that digital assets might play a role in bolstering demand for the U.S. dollar amid global de-dollarization trends led by BRICS nations. This move could further extend U.S. dollar dominance by integrating collateralized stablecoins into the U.S. debt market, potentially mitigating some of the inflationary pressures from past quantitative easing and fiscal policies

Reference: Cointelegraph

D. Macroeconomy

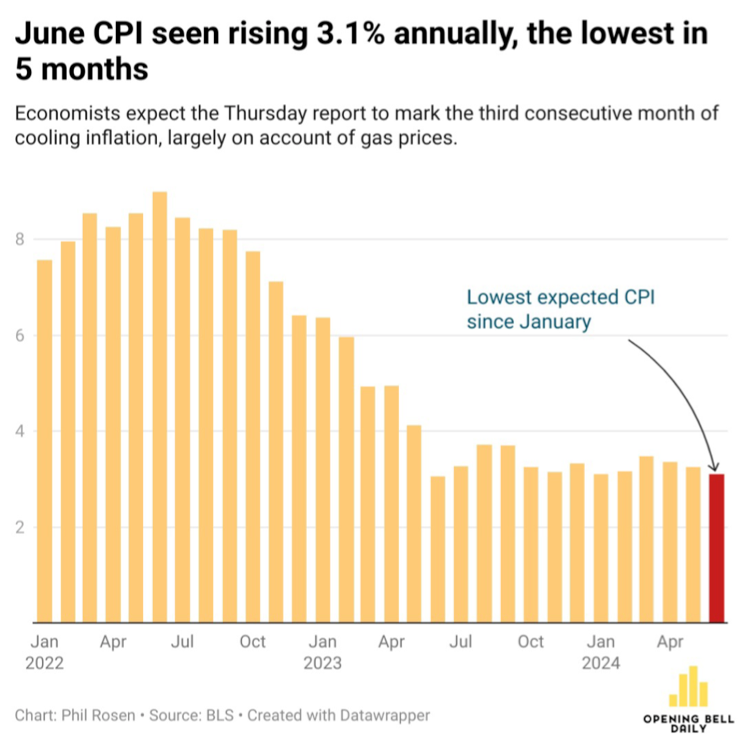

1. U.S. inflation slows in June, boosting odds of September Fed rate cut

In the U.S., bond yields and the dollar value fell after June inflation data came in lower than expected. The implied probability of a September Fed rate cut jumped from 72% to 92%. June's consumer price index (CPI) rose 3% year-over-year, the smallest increase in a year, and was down 0.1% from May. Core CPI, excluding volatile food and energy prices, increased 3.3% year-over-year—its lowest since April 2021—and was up 0.1% month-over-month. Durable goods prices dropped significantly, with declines of 4.1% year-over-year in June, including falls of 10.1% for used vehicles and 10.3% for smartphones. In contrast, non-durable goods prices rose 1.3%, driven mainly by a 2.2% increase in food prices. Excluding food, non-durables prices were up only 0.3%. Service prices increased 5% year-over-year, with shelter and hospital services rising by 5.2% and 6.9%, respectively. However, car rental and airline fares fell 6.3% and 5.1%. Labor costs are rising but at a slower rate, and Fed Chair Powell noted that the labor market is no longer a major inflation concern. This suggests that the Fed may be poised to cut interest rates.

Reference: Delloite insights,inc.com

2. Japan GDP growth forecast downgraded amid mixed economic data

With speculation mounting about whether the Bank of Japan (BoJ) might raise interest rates at its July 30–31 meeting and reveal details on tapering its extensive bond purchases, the yield on the 10-year Japanese government bond dipped to 1.04%, down from 1.06% the previous week. Economic data for June showed the nationwide core consumer price index (CPI) rising by 2.6% year-over-year, slightly above May's 2.5% but below the consensus estimate of 2.7%. Overall inflation held steady at 2.8% year-over-year, despite expectations of a rise. In response to ongoing economic challenges, the government has revised its GDP growth forecast for the fiscal year ending March 2025 down to 0.9% from January's projection of 1.3%. This downgrade reflects sluggish domestic consumption and rising import costs, driven by a weakening yen that impacts household purchasing power. The forecast for the fiscal year beginning April 2025 anticipates a 1.2% growth, supported by expected demand-led economic recovery.

Reference: T Rowe Price

I like your cover. It keeps giving me new surprises every week!