The recent appointments by President-elect Donald Trump have generated significant excitement within the cryptocurrency sector. His crypto-supportive team has amplified market enthusiasm, pushing Bitcoin's price to an all-time high as the industry rallies around the news. Our team has analyzed each appointee to assess the long-term implications of Trump’s administration on the crypto landscape.

Key Appointments and Their Implications

1. David Sacks – White House AI and Crypto Czar

Sacks, a entrepreneur, investor, and advocate for cryptocurrencies, with a career spanning multiple successful ventures. He is the founding partner of Craft Ventures, a VC firm that invests in tech and crypto. Previously, Sacks was the COO of PayPal during its early days. Sacks has been an advocate for economic freedom, decentralization, and sensible crypto regulation. He has been involved in shaping crypto policy through his connection with political leaders, including his recent role as part of President-elect Trump’s pro-crypto team. His appointment highlights the administration’s intent to integrate cryptocurrency and AI into national policy, potentially creating a favorable environment for technological growth.

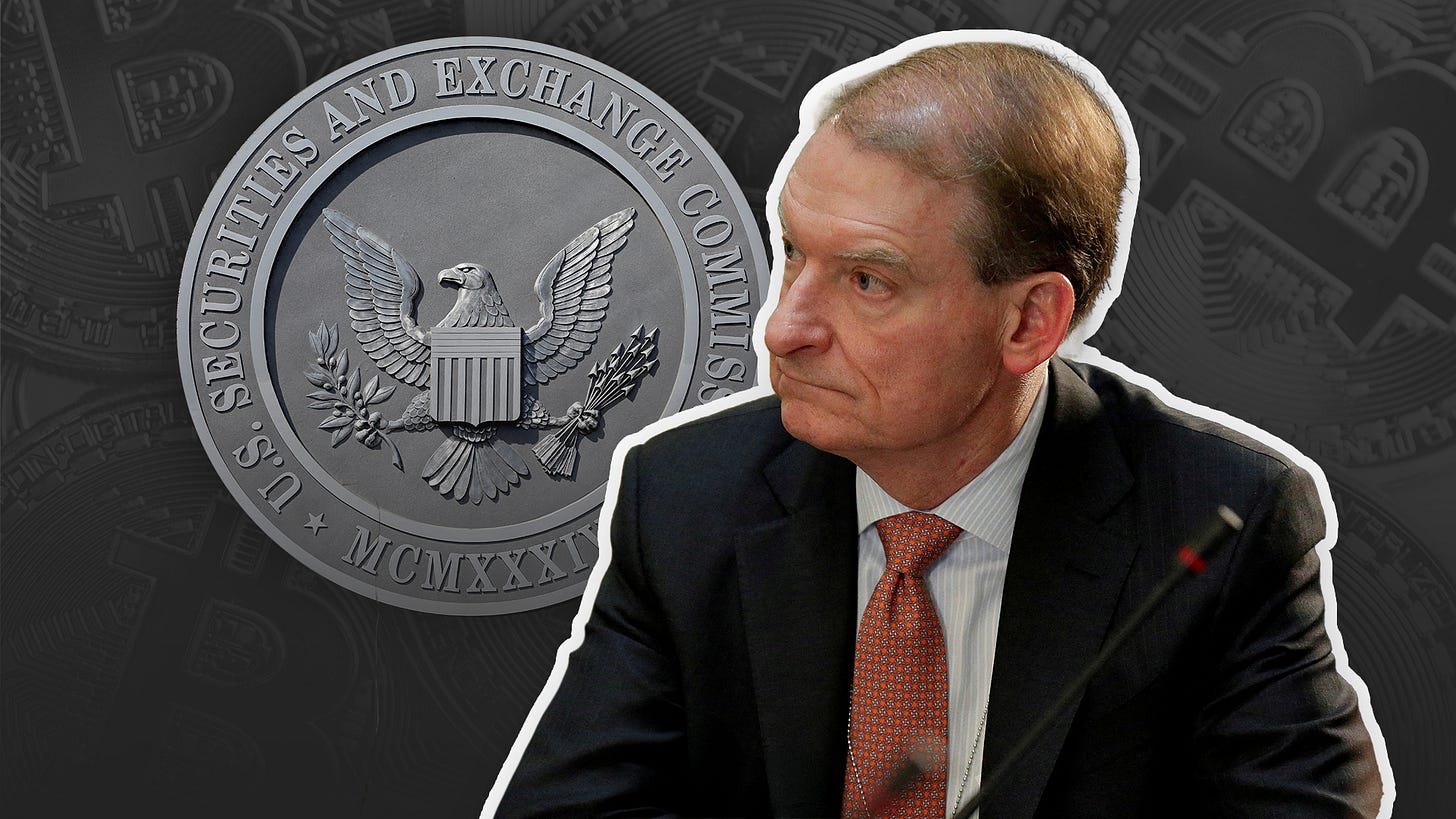

2. Paul Atkins – SEC Chairman Nominee

Atkins served as a commissioner for the U.S. Securities and Exchange Commission (SEC) from 2002 to 2008, where he advocated for market-oriented policies and reduced regulatory burdens. He has been a prominent voice in pushing for regulatory clarity in emerging financial technologies, including cryptocurrencies. He has consistently emphasized the importance of balancing investor protection with fostering innovation. Atkins’ nomination underscores a clear effort to address regulatory uncertainty in the crypto industry. As co-chair of the Digital Chamber’s Token Alliance since 2017, he has consistently supported initiatives that balance consumer protection with innovation. His leadership at the SEC is expected to bring much-needed clarity to the regulatory framework.

3. Stephen Miran – Chair of the Council of Economic Advisors

The council advises the president on economic policy, assists in the preparation of an annual report that gives an overview of the country's economy, reviews federal policies and programs and makes economic policy recommendations. Stephen Miran is a economist with a focus on deregulation and economic policy. He is best known for his role as an economic advisor with a strong commitment to fostering technological advancement and free-market principles. He is an advocate for streamlining regulatory processes, enabling new technologies like Bitcoin to thrive in a competitive global economy. Miran's ability to shape national economic policies could therefore play a critical role in determining the future regulatory landscape for cryptocurrencies in the U.S.

4. Rep. French Hill-Chairman of the House Financial Services Subcommittee on Digital Assets

Rep. Hill has served in the U.S. House of Representatives since 2015. He has been involved in numerous legislative efforts, focusing on economic policy, financial services, and digital asset regulation. Rep. Hill has elected to be Chairman of the House Financial Services Subcommittee on Digital Assets and has been a vocal advocate for creating a structured regulatory framework for cryptocurrencies and digital assets. Rep. Hill has identified a digital asset market structure bill as a priority for the Republican Party. His statements have stressed the importance of developing clear rules that will foster innovation, while also making sure that digital assets don’t become a vehicle for illegal activity or instability.

Outlook for the Crypto Industry

If the Trump administration follows through on its pledges, the U.S. could experience:

Enhanced Regulatory Clarity: Clear guidelines could attract institutional investment and drive industry innovation.

Improved Market Confidence: A well-structured framework may mitigate risks and encourage broader adoption of digital assets.

Global Leadership: Proactive support for cryptocurrencies could establish the U.S. as a leader in financial innovation.

However, delays or failure to act decisively could perpetuate uncertainty and market instability. The crypto community remains cautiously optimistic, awaiting tangible policy actions that translate this promising momentum into long-term growth opportunities.

Reference: MayerBrown, Pensions&Investments, Time

IMF-Driven Revisions to Bitcoin Law

El Salvador and the IMF have reached an agreement on a $1.4 billion loan program, to be disbursed over 40 months, according to an IMF statement. In return, El Salvador has committed to implementing measures aimed at improving its primary balance and reducing its debt-to-GDP ratio. As part of the conditions for a new IMF loan package, President Nayib Bukele of El Salvador has agreed to revise key aspects of the country's groundbreaking Bitcoin Law enacted in 2021. The changes include:

Ending the Legal Tender Mandate: Businesses are no longer required to accept Bitcoin as a form of payment.

Shutting Down Chivo Wallet: The state-run wallet, plagued with technical issues, will cease operations.

Halting Bitcoin Tax Payments: Bitcoin will no longer be accepted for tax obligations.

Backlash and Misunderstandings

Critics on social media have accused Bukele of abandoning his commitment to Bitcoin, framing these changes as a betrayal. However, such reactions fail to recognize the broader context of his leadership.

Leadership Priorities

Bukele’s primary responsibility is to the Salvadoran people, not the global Bitcoin community. El Salvador faces profound challenges, including poverty, crime, and underdeveloped infrastructure. These realities necessitate pragmatic governance, where Bitcoin serves as a tool—not an ideology.

Expecting Bukele to prioritize Bitcoin over the well-being of his nation is both unrealistic and misaligned with the role of a national leader. The decision to modify the Bitcoin Law reflects a calculated effort to balance innovation with the pressing needs of the Salvadoran populace.

Implications

Investor Sentiment and Confidence: Bitcoin investors, particularly those who saw El Salvador's Bitcoin adoption as a milestone for mainstream acceptance, expressed disappointment over the reversal. Bitcoin experienced dip in value on the day the news broke.

IMF Dynamics: The IMF’s involvement also fueled concerns, as it was seen as a sign that traditional financial institutions were exerting influence over a policy that was once viewed as groundbreaking for Bitcoin adoption. Some traders and investors worried that further pressure from the IMF could lead to additional regulatory restrictions, potentially dampening future market enthusiasm. The concessions demonstrate the leverage international institutions hold over nations experimenting with alternative financial systems. This could prompt a reassessment of Bitcoin adoption strategies in the face of external pressures.

Setback to Bitcoin as “Medium of Exchange": El Salvador's scaling back of its Bitcoin Law could significantly slow the growth of Bitcoin as a medium of exchange, as the country had been seen as the most iconic and pioneering example of fostering a Bitcoin circular economy. The government has reduced the incentives for businesses and consumers to adopt Bitcoin for everyday transactions. As a result, the dream of creating a Bitcoin-driven economy in El Salvador, where the cryptocurrency could circulate seamlessly, faces a major setback, potentially delaying or even derailing Bitcoin’s path to becoming a widely used and accepted global currency.

President Bukele’s revisions to the Bitcoin Law are not a betrayal or rejection of Bitcoin, but a pragmatic adjustment to better serve the needs of El Salvador. Bitcoin remains an important tool in the nation’s economic strategy, but its utility must be balanced with other pressing priorities. El Salvador is still committed to purchasing Bitcoin and is likely to accelerate its pace. Ultimately, it's essential to remove the rose-tinted glasses and recognize the reality of a more mature and practical approach to integrating Bitcoin within a complex national economy.

Reference: Yahoo Finance, BitcoinMagazine

1. MicroStrategy to turn to fixed-income securities to raise funds for Bitcoin purchases

MicroStrategy, led by co-founder Michael Saylor, is shifting its funding strategy for Bitcoin purchases. Once its current fundraising plan is fully utilized, the company will move from using Bitcoin proxies to focusing on fixed-income securities. Previously, MicroStrategy has funded Bitcoin acquisitions through stock and convertible bond sales, with convertible bonds yielding positive returns as the company’s stock price rose. Saylor emphasized leveraging strategies to enhance shareholder value, noting that $4 billion of their $7.2 billion in convertible notes act as equity. This pivot aligns with a broader market trend where hedge funds are increasingly using fixed-income securities for convertible arbitrage, prompting MicroStrategy to issue $6.2 billion in convertible bonds this year. The move positions the company to adapt to the changing investment landscape while maximizing returns for shareholders.

Reference: Bloomberg

2. Russia Is Using Bitcoin for International Trade

Russian Finance Minister Anton Siluanov announced that Russian companies have started using Bitcoin and other digital currencies for international payments, a move in response to recent legislative changes aimed at countering Western sanctions. Additionally, lawmaker Anton Tkachev proposed creating a Bitcoin reserve, similar to foreign exchange reserves, to mitigate risks from sanctions, inflation, and currency fluctuations. This marks a step toward greater economic sovereignty and resilience.

Reference: The block beats

3. Japanese Government Responds to Proposal for Establishing Bitcoin Reserve

The Japanese government recently responded to a proposal by Senator Satoshi Hamada regarding the consideration of Bitcoin as a reserve asset, a trend gaining traction in countries like the U.S. While acknowledging the growing global interest in cryptocurrencies, the government expressed that discussions on Bitcoin’s role as a reserve asset are still in early stages and refrained from forming an opinion. Citing its legal framework, Japan emphasized that cryptocurrencies like Bitcoin are not classified as foreign exchange and do not align with the objectives of maintaining stable and liquid foreign exchange reserves. Japan’s cautious approach reflects its commitment to economic stability while evaluating the potential integration of digital assets.

Reference: coin post

Happy New Year from Team HCM! As we welcome the new year, we are excited to celebrate not only the joy of the season but also the growth and progress of the Bitcoin community. Reflecting on 2024, we made significant strides and embraced new changes. The official HCM website is set to launch at early January of the year 2025, marking an exciting new chapter for our team. Looking ahead, we are enthusiastic about the future and the global adoption of Bitcoin, which will continue to grow stronger and more impactful. Here's to an incredible journey ahead, filled with innovation, collaboration, and success! Cheers to 2025!