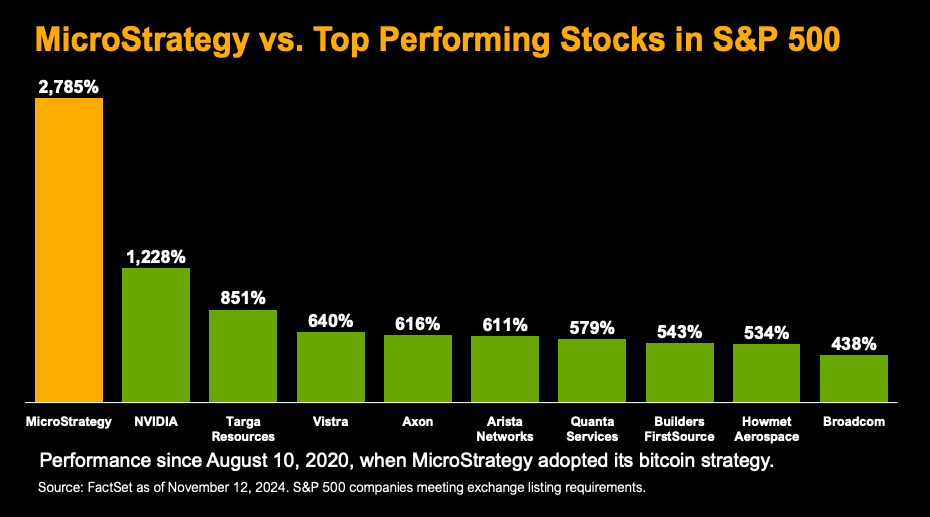

MicroStrategy's bitcoin strategy has recently gained significant attention, as the company utilizes a combination of cash, debt, and equity to acquire bitcoin, amassing a total of 386,700 BTC—representing 1.83% of the global bitcoin supply. Under the leadership of Executive Chairman Michael Saylor, MicroStrategy has redefined corporate treasury management with its innovative approach to bitcoin acquisition. Saylor, a prominent bitcoin advocate, has successfully positioned the company as a leader in the financialization of bitcoin, blending traditional financial tools with cutting-edge strategies to integrate the digital asset into the corporate balance sheet.

Reference: Bitcoin, the red wave, and the crypto renaissance-Michael Saylor

A Strategic Shift: From Analytics to Bitcoin

Founded in the 1990s as a business intelligence firm, MicroStrategy initially focused on B2B analytics tools. However, its value proposition took a dramatic turn in 2020 when Saylor adopted bitcoin as a core treasury asset. This shift was based on his belief that bitcoin’s long-term appreciation potential and low carrying costs would outperform traditional assets, especially in a world of inflationary fiat currencies.

How the Model Works

MicroStrategy finances its bitcoin purchases through a combination of retained earnings, debt instruments, and equity offerings. The company introduced the concept of "bitcoin yield," which measures the increasing amount of bitcoin holdings per share over time. Investors are attracted to MicroStrategy's shares as a proxy for bitcoin exposure, particularly when direct bitcoin acquisition or spot ETFs are not feasible for regulatory or institutional reasons.

Leveraging Capital Markets for Bitcoin

Saylor’s strategy capitalizes on inefficiencies in traditional financial markets. By issuing convertible notes and other low-interest debt, MicroStrategy converts inflating fiat capital into bitcoin, a deflationary digital asset. This speculative attack on fiat currency hinges on two key assumptions:

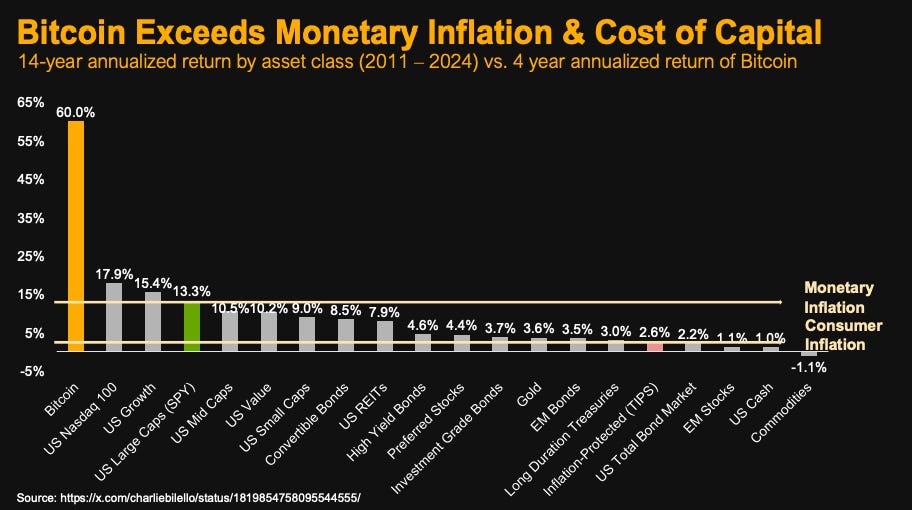

Bitcoin will appreciate by approximately 25% annually over the long term.

MicroStrategy can continue to secure low-interest financing below bitcoin's annualized appreciation rate.

The company also monetizes bitcoin's volatility by engaging in options trading, further amplifying returns.

Why MicroStrategy Matters

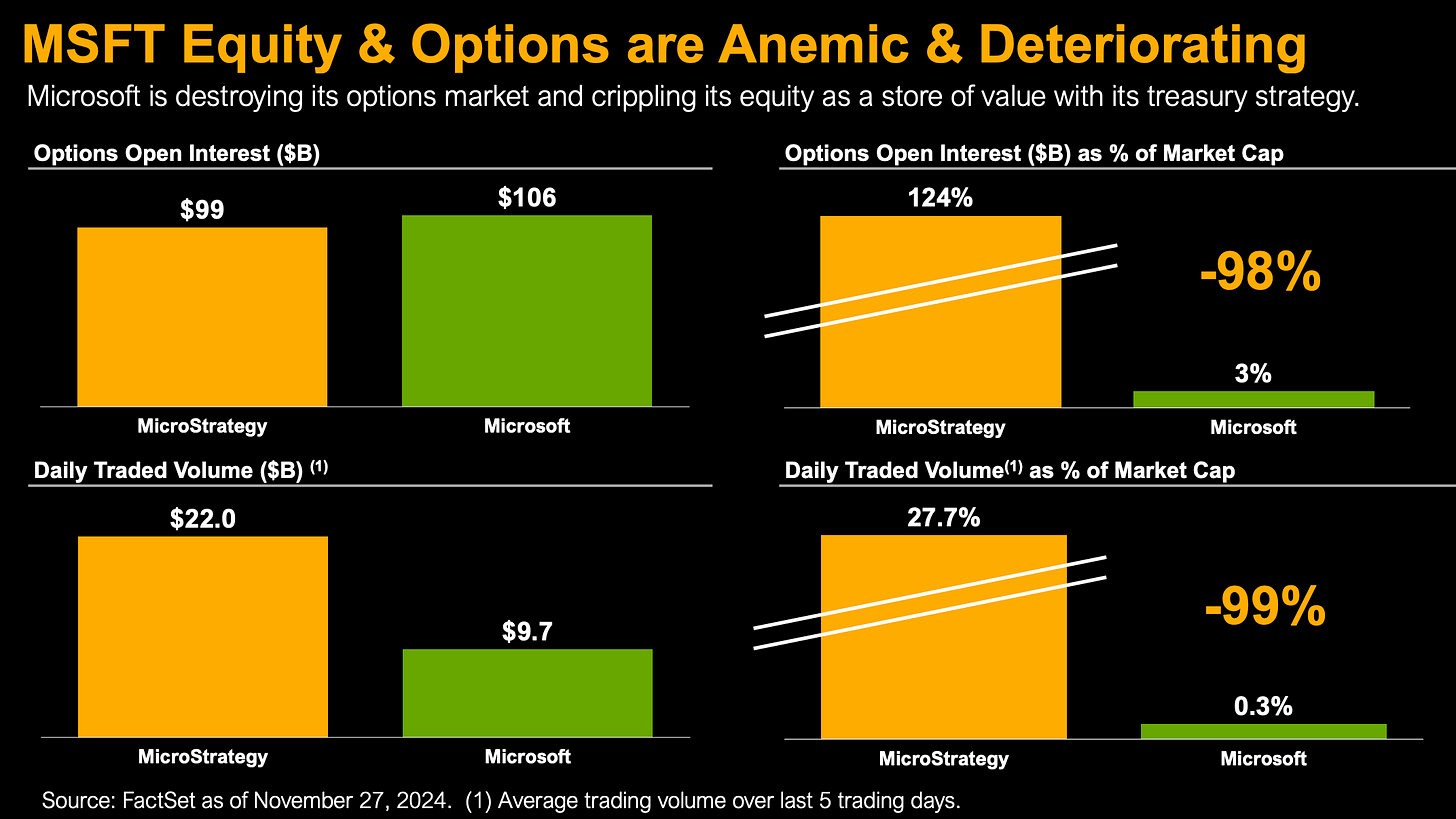

MicroStrategy is not just a corporate bitcoin investor; it is a trailblazer driving bitcoin's integration into mainstream finance. Michael Saylor recently recommended to Microsoft's board of bitcoin strategy, noting that Microsoft has surrendered hundreds of billions in capital, increasing shareholder risk, but bitcoin offers a counterparty-risk-free asset. Converting cash flows, dividends, and debt into bitcoin could boost stock price, create trillions in value, and reduce risks for shareholders.

Reference: Bitcoin, the red wave, and the crypto renaissance-Michael Saylor

By adopting a bitcoin treasury strategy, MicroStrategy has inspired other firms, including Metaplanet, Semler Scientific, and Rumble, to follow suit. If bitcoin achieves widespread adoption on corporate balance sheets, MicroStrategy will be remembered as a financial innovator that paved the way for a new era of capital management. Its bold approach demonstrates how leveraging the predictability of bitcoin can challenge the status quo of legacy financial systems while accelerating the adoption of decentralized digital assets.

As bitcoin increasingly establishes itself as a store of value, gaining more attention from the broader market due to its price appreciation and the influence of the Trump administration, we compare four key assets—oil, gold, USD, and bitcoin—and provide a comprehensive analysis of their roles and characteristics in today’s financial landscape.

A. Oil

Oil has been essential to global development since the mid-19th century, with the first commercial well drilled in 1859. Throughout the 20th century, it became a key driver of economic growth, transportation, and urbanization. Major events like the 1973 OPEC oil embargo and the shale revolution have shaped the global oil landscape.

Geopolitical Sensitivity: Oil prices are highly impacted by political events, such as conflicts in oil-rich regions or sanctions, making oil a barometer for global stability.

Pricing Control: Oil pricing is largely determined by entities like OPEC and major producers, influencing market dynamics to balance supply and demand.

Strategic Resource: Oil is critical for industries, transportation, and national energy reserves, making it vital for infrastructure and defense.

B. Gold

Gold has been a symbol of wealth for millennia, shaping economic policies and serving as a store of value during financial crises. Its role as a safe haven asset remains central to wealth preservation.

Safe Haven: Gold’s intrinsic value and limited supply make it a preferred asset during economic uncertainty, preserving purchasing power over time.

Risk Diversification: Adding gold to an investment portfolio stabilizes risk, particularly when other assets like stocks or currencies are volatile.

Liquidity and Global Acceptance: Gold’s universal recognition ensures its role as a liquid, trusted asset with easy conversion into cash.

C. The U.S. Dollar

The U.S. dollar became the global currency post-WWII, supported by the Bretton Woods system and the U.S. economy. Though the gold standard ended in 1971, the dollar's dominance continues due to its role in international trade and finance.

Political Influence: U.S. policies, such as interest rates and fiscal decisions, directly affect the dollar’s value.

Economic Dependency: The dollar’s performance is tied to the U.S. economic cycle, influenced by policies like quantitative easing.

Global Trade Link: The dollar’s role in pricing commodities like oil and serving as the primary reserve currency strengthens its bond with the global economy.

D. Bitcoin

Bitcoin, introduced in 2009 by an anonymous creator under the pseudonym Satoshi Nakamoto, represents a paradigm shift in financial systems. Designed as a decentralized digital currency, it has grown from a niche experiment into a widely recognized asset, attracting both retail and institutional investors.

a. Hedge Against Inflation

With its fixed supply of 21 million coins, bitcoin serves as a digital alternative to gold, offering protection against inflationary pressures caused by excessive money printing in traditional fiat systems.

b. High Volatility and Sensitivity to Market Signals

Bitcoin’s price is prone to fluctuations, reflecting its emerging status and sensitivity to market sentiment, regulatory news, and macroeconomic factors.

c. Capital Appreciation

Despite its volatility, bitcoin has demonstrated substantial long-term appreciation, driven by increasing adoption, institutional interest, and its growing role as a store of value in the digital age.

Reference: Bitcoin, the red wave, and the crypto renaissance-Michael Saylor

E. Bitcoin as a National Strategic Reserve

a. Potential Dominance in Future Economic and Financial Order

The adoption of bitcoin as a national strategic reserve could symbolize a shift in the balance of global financial power. Countries that accumulate bitcoin early may gain a significant advantage in the emerging digital economy. With its decentralized nature and finite supply, bitcoin has the potential to play a pivotal role in a redefined global monetary system, reducing reliance on traditional reserve currencies like the US dollar.

b. Asset Appreciation and Long-Term Holding Trends

As more nations and institutions adopt bitcoin as a reserve asset, its value is likely to increase due to its scarcity and growing demand. Bitcoin’s deflationary design incentivizes long-term holding, which could stabilize its traditionally volatile market over time. This dynamic may not only benefit countries that hold bitcoin but also encourage greater confidence in its use as a strategic reserve.

c. Hedge Against Inflation and Fiat Currency Depreciation

Bitcoin’s resistance to inflation and its independence from central banks make it an attractive option for hedging against the devaluation of fiat currencies. By including bitcoin in their reserves, governments can optimize their asset allocation, ensuring greater financial resilience in times of economic uncertainty or monetary instability. This strategy could serve as a safeguard against the erosion of national wealth in the face of global inflationary pressures.

Trump Admin Eyes CFTC to Lead Digital Asset Regulation

The incoming Trump administration plans to expand the authority of the Commodity Futures Trading Commission (CFTC) to oversee a substantial portion of the $3 trillion digital asset market. This initiative is part of a broader effort by President-elect Donald Trump and the Republican majorities in Congress to reduce the regulatory power that the Securities and Exchange Commission (SEC) has exercised over the digital asset industry under President Biden and outgoing SEC Chairman Gary Gensler. The CFTC, known for its oversight of the $20 trillion U.S. derivatives market, is perceived to have a lighter regulatory approach compared to the SEC, as it primarily engages with sophisticated institutional investors.

Sources indicate that the CFTC could gain regulatory power over spot markets for digital assets classified as commodities, such as bitcoin and ethereum, along with the exchanges that facilitate their trading. This shift would provide much-needed regulatory clarity for participants in the cryptocurrency market, which has been characterized by uncertainty regarding asset classification and regulatory jurisdiction. The SEC, under Gensler, has predominantly taken an enforcement-based approach, leading to tensions with the crypto industry, which favors the CFTC as a more favorable regulator.

Former CFTC Chairman Chris Giancarlo, who is being considered for a new role as "crypto czar" in the Trump administration, has advocated for the agency's expanded role in regulating digital assets. Giancarlo's tenure as chair included early engagement with cryptocurrencies and the approval of bitcoin futures trading. He believes that with sufficient funding and leadership, the CFTC could begin regulating digital commodities immediately upon Trump's inauguration, potentially fostering innovation in the sector while clarifying regulatory oversight.

Reference: foxbusiness

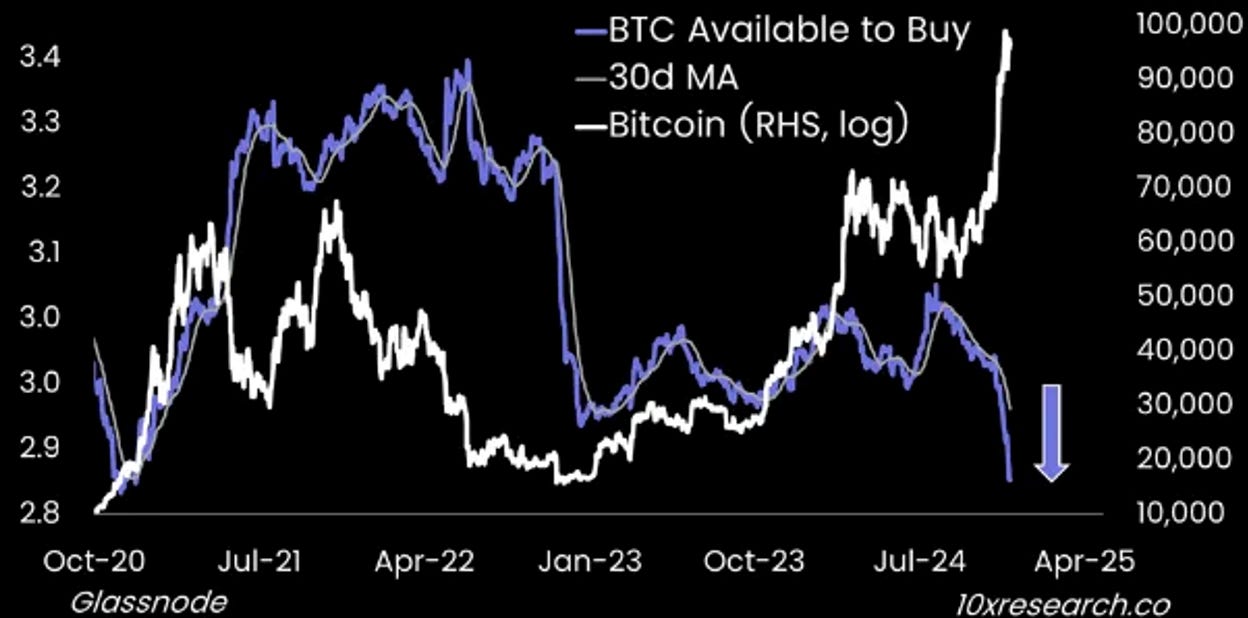

Bitcoin Exchange Balances Plunge as Long-Term Holders Help Drive Price

Bitcoin balances on cryptocurrency exchanges have reached historic lows, indicating a significant depletion of available inventory. A recent report from 10X Research highlighted this trend, noting a sharp decline in the amount of bitcoin available for purchase. In contrast to a brief replenishment of exchange reserves observed last summer, this time has seen no such influx, exacerbating the ongoing supply crunch.

The tightening supply of bitcoin comes amid favorable catalysts for the market, including promises from President-elect Donald Trump to establish a bitcoin reserve in the U.S. and to support bitcoin mining interests. These developments have contributed to bitcoin's price approaching $100,000, enhancing its appeal as a store of value. On-chain analytics indicate that long-term holders are retaining their bitcoin, further limiting liquidity on exchanges. Currently, only three major exchanges—Bitfinex, Binance, and Coinbase—have sufficient reserves to meet demand, while smaller exchanges struggle with liquidity, potentially leading to increased price volatility.

As demand continues to grow from both retail and institutional investors, including interest in bitcoin-related financial products like spot ETFs, the shrinking inventory on exchanges could create upward price pressure. This situation suggests that the divergence between available supply and price may persist, reinforcing bitcoin's position in the market as a valuable asset.

Reference: decrypt

Bit Theory: Decoding Bitcoin, One Theory at a Time

Bit Theory aims to simplify bitcoin for beginners by providing clear, practical insights and easy-to-understand education. Follow Bit Theory on X.com: @btc_bread for more insights.