Bitcoin has experienced a notable 129.2% price increase this year, with a solid 8.9% gain this month alone. This rise has been driven by an improving risk-on sentiment in the market, spurred by better-than-expected earnings from major Wall Street firms. The strong earnings reports have helped bolster investor confidence, contributing to a broader appetite for riskier assets like Bitcoin, which has been increasingly seen as a hedge against traditional financial uncertainties.

Additionally, growing speculation around a potential Federal Reserve rate cut in November has further fueled Bitcoin's momentum. Investors are factoring in the possibility that the Fed may pivot from its current monetary tightening, which could lead to a more favorable macroeconomic environment for assets like Bitcoin that thrive in low-interest-rate scenarios.

Moreover, the political landscape is playing a significant role in driving Bitcoin's price action. The increasing odds of pro-Bitcoin candidate Donald Trump winning the 2024 presidential election are adding to market optimism. Trump's favorable stance on cryptocurrency and his potential return to office are viewed by many investors as a catalyst for more crypto-friendly regulations and policies, further boosting Bitcoin's appeal.

In combination, these factors—improving market sentiment, potential Fed rate cuts, and political developments—are creating a bullish outlook for Bitcoin as we move toward the end of 2024. Investors are increasingly viewing Bitcoin as both a hedge and a speculative asset, positioning it well in the current economic and political climate.

Reference: Yahoo Finance

Tesla transfers $765 million to self-custody wallets, highlighting the importance of Bitcoin self-custody. Bitcoin self-custody refers to the practice of directly controlling and managing your own Bitcoin holdings, rather than relying on a third-party custodian such as a cryptocurrency exchange or wallet service. When you hold Bitcoin in self-custody, you are responsible for securely storing your private keys—unique cryptographic codes that grant access to your Bitcoin and allow you to send or spend it. This approach gives individuals full control over their assets and eliminates the need to trust a centralized institution with their funds.

Self-custody is a critical component of Bitcoin’s ethos, which emphasizes decentralization, financial sovereignty, and the ability to own and transfer wealth without reliance on intermediaries. By opting for self-custody, individuals are empowered to truly "own" their Bitcoin, free from the risks associated with third-party custodians, such as hacks, mismanagement, or insolvency. The mantra "Not your keys, not your coins" reflects the idea that if someone else holds your private keys, they effectively control your Bitcoin, and you are at risk of losing access.

The Importance of Multisignature in Bitcoin Self-Custody

While self-custody offers enhanced control and security, it also comes with the responsibility of safeguarding your private keys. Losing access to these keys means losing access to your Bitcoin permanently, which can be a daunting prospect. This is where multisignature (multisig) technology plays a crucial role in bolstering the security of Bitcoin self-custody.

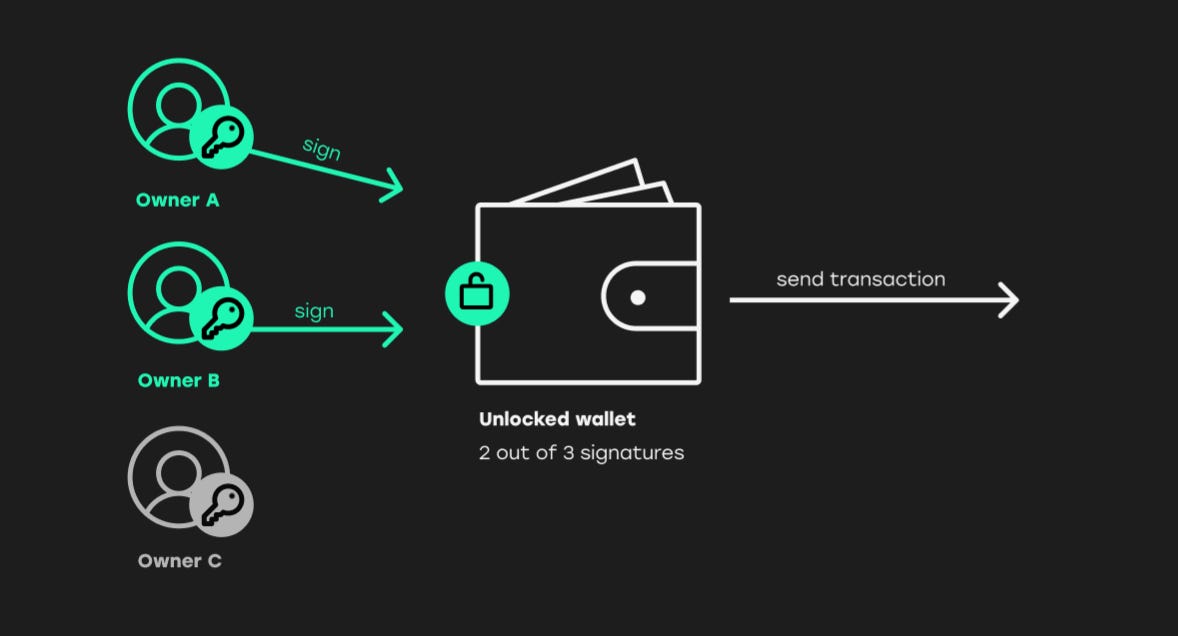

Multisignature refers to a security feature that requires multiple private keys to authorize a Bitcoin transaction, rather than relying on a single key. For example, a 2-of-3 multisig setup might require two out of three designated keys to approve any movement of funds. This adds an extra layer of protection in several ways:

Enhanced Security: Multisig helps mitigate the risk of a single point of failure. If one key is lost, stolen, or compromised, the funds are still safe because the attacker would need access to multiple keys. This protects against theft, hacking, and loss of keys.

Redundancy and Backup: With a multisig setup, you can distribute your keys across different locations or devices, ensuring that even if one key is lost or damaged, you can still recover your funds using the remaining keys. For example, you might store one key on a hardware wallet, another in a safe, and give a trusted family member or service provider control of the third.

Shared Control: Multisig is particularly useful in shared ownership scenarios, such as for businesses, trusts, or family members who want joint control over Bitcoin holdings. It ensures that no single individual can act alone in transferring or spending the Bitcoin, which provides a governance structure and reduces the risk of rogue actors.

Mitigating Human Error: Managing private keys can be intimidating, especially for individuals new to Bitcoin. Multisig setups can reduce the risk of human error by allowing for the recovery of funds even if a single key is lost or forgotten. It provides a balance between the autonomy of self-custody and the security measures of traditional custodianship.

Multisignature solutions offer a powerful tool to enhance security, reduce risks, and provide flexibility in managing Bitcoin holdings. By combining self-custody with multisig, users can significantly reduce the likelihood of loss or theft while maintaining full control over their assets.Some prominent Multisig platforms: Unchained Capital, Lumin, Casa

Reference:Multis.co, Unchained Capital, Lumin, Casa

Bitcoin Hashrate Hits All-Time High, Signaling Stronger Network Security and Potential Miner Consolidation

The Bitcoin hashrate has reached a new all-time high of 791.6 exahashes per second (EH/s) on Oct. 21, reflecting the increasing security of the network. This rise, driven by advancements in mining hardware like ASICs, has been on a steady upward trend since 2021.

While a higher hashrate boosts the security of the Bitcoin network, it also increases the cost to mine 1 BTC, potentially leading to miner consolidation, especially for smaller firms with less efficient rigs. With the 2024 Bitcoin halving reducing block rewards, energy-efficient mining equipment will be essential for profitability.

Despite the rising mining costs, Bitcoin miners have not significantly increased their selling, minimal miner transfers to centralized exchanges during this period.

Reference: Ycharts, Cointelegraph

Nearly Half of Traditional Hedge Funds Now Invest in Digital Assets Amid Regulatory Clarity and ETF Launches

Nearly half of hedge funds focused on traditional assets now have exposure to cryptocurrencies, driven by clearer regulations and the launch of ETFs in the U.S. and Asia, according to the Global Crypto Hedge Fund Report by AIMA and PwC.

The report revealed 47% of traditional hedge funds now invest in digital assets, up from 29% in 2023. Of those, 67% plan to maintain their digital assets investments, while the rest intend to increase by year-end.

Hedge funds, once focused on spot trading, are now deploying more sophisticated strategies. In 2024, 58% traded crypto derivatives, up from 38% in 2023, while spot trading dropped to 25% from 69%.

Reference: Pwc

UAE Exempts Digital Assets Transactions from VAT, Aligning with Traditional Financial Services

The United Arab Emirates (UAE) has exempted cryptocurrency transactions from value-added tax (VAT), aligning the industry with several traditional financial services. Effective Nov. 15, this change retroactively applies to transactions dating back to Jan. 1, 2018. The Arabic version of the Federal Tax Authority’s update was released on Oct. 2, 2024, with the English translation following on Oct. 4.

This exemption clarifies that digital assets are not subject to the 5% VAT. It covers the exchange and transfer of ownership of cryptocurrencies, meaning all digital assets transfers and conversions are now VAT-exempt.

"The UAE has essentially classified virtual assets in the same category as traditional financial services, many of which are already VAT-exempt. This move legitimizes virtual assets," said Ankita Dhawan, a senior associate at the Métis Institute, a dispute resolution think tank.

Reference: CoinDesk, Cryptopolitan

We are going to El Salvador!

Our managing partner will be speaking at Adopting Bitcoin 2024! If you're a founder, entrepreneur, or Bitcoin enthusiast, feel free to reach out. We look forward to hearing from you!

Reference: X.com

LifPay NFC Card Manufacturing Program has officially launched!

Reference: X.com

good to know all these news