The Federal Reserve has announced a 50-basis-point reduction in the benchmark interest rate, officially initiating the first easing cycle in U.S. monetary policy since March 2020. This move aims to address potential weaknesses in the U.S. economy and labor market while further reducing inflation. Fed Chair Jerome Powell emphasized that current economic conditions are strong, and the rate cut is designed to sustain this momentum and enable a flexible response to changing conditions.

Fed officials expect additional rate reductions for the remainder of the year, gradually lowering rates over the next few years. This easing cycle is anticipated to have significant implications for the future of the U.S. economy, influencing the rates at which banks extend loans to both individuals and businesses. As a result, borrowing costs for consumers—such as home mortgages and credit card debt—are likely to decrease.

The news supported bitcoin prices, with bitcoin recently near $63,000. Bitcoin prices tend to rise on signs of monetary easing, as they are broadly seen as risk-on assets even as some investors tout their use as safe havens.

In the long run, increased borrowing and spending can lead to stronger economic growth, which may further enhance liquidity in the system. However, while liquidity may initially increase, prolonged low rates can also lead to potential risks, such as asset bubbles and excessive debt levels. Monitoring these factors is essential to maintain financial stability.

Reference: Trading Economics, Reuters

The Nostr ecosystem is known for its decentralization and focus on sovereign identity, offering a unique advantage for users. With more than 100 applications across social media, entertainment, marketplace and more, Nostr's key strengths include:

Decentralization and Sovereignty: Protects users' privacy from censorship.

Integration with payment system: Enhances features like zapping and streaming.

While these aspects attract Bitcoin enthusiasts, broader user adoption will require more sustainable and diverse features. Over the next few years, various opportunities and challenges may arise.

Social Media

Nostr represents a significant opportunity in decentralized social media, giving users control over their data and promoting free speech. Users can zap each other’s content through the Bitcoin Lightning Network. Nostr’s interoperability allows users to share posts across platforms, enabling a more integrated experience. Unlike traditional social media, where data is siloed, Nostr fosters collaboration among apps, allowing users to switch easily based on their needs. Over the next few years, we can expect a thriving ecosystem.

Identification and Login

Nostr's decentralized identity system relies on public and private keys, making it a fundamental feature. While no standalone disruptive applications are expected, this identification functionality can enhance social media and wallet apps by integrating features that improve competitiveness.

Decentralized Marketplace

Nostr's secure communication framework can facilitate decentralized marketplaces, enabling direct buyer-seller interactions while enhancing privacy. These marketplaces could extend beyond traditional goods to include music, writing, and services.

Regulation in the Nostr Ecosystem

As a censorship-resistant platform, Nostr might faces unique regulatory challenges. The protocol itself is neutral, but how developers manage relays will determine oversight levels. Proper regulation might prevent illegal activities and enhance the credibility of apps, helping Nostr grow without stifling its decentralized spirit. Developers focusing on decentralization may find opportunities in regulatory advising, ensuring that Nostr apps adhere to principles of decentralization while fostering healthy growth.

MicroStrategy Raises $1.01 Billion in Convertible Notes to Fuel Bitcoin Acquisitions

MicroStrategy has completed a $1.01 billion offering of 0.625% convertible senior notes due in 2028, with plans to acquire Bitcoin using part of the proceeds. The private offering, finalized on Sept. 19, targeted institutional investors and allows conversion into cash or MicroStrategy stock. The company will also redeem $500 million in senior secured notes, releasing collateral that includes 69,080 Bitcoin. Between Sept. 13 and 19, MicroStrategy purchased approximately 7,420 Bitcoin for about $458.2 million, averaging $61,750 per Bitcoin.

Reference: Microstrategy, Cointelegraph

Bhutan Revealed as Major Bitcoin Holder with 13,093 BTC

Bhutan, the Buddhist kingdom in the eastern Himalayas, has emerged as a significant Bitcoin holder, owning 13,093 BTC valued at approximately $830.789 million, according to Arkham Intelligence. This is the first public disclosure of Bhutan's Bitcoin addresses.

Mining is conducted by the country's investment arm, Druk Holdings, which has established facilities at various sites, including the defunct Education City project. In May 2023, Bitdeer partnered with Druk Holding & Investments to develop a 100% carbon-free Bitcoin mining operation in Bhutan. Earlier reports indicated plans to expand mining capacity from 100 to 600 megawatts, leveraging the country's abundant hydropower resources for eco-friendly operations.

Reference: Arkham, Bitcoin Magazine

Donald Trump Makes History with Bitcoin Payment

Republican Party presidential nominee Donald Trump made history as the first former U.S. president to complete a Bitcoin payment at PubKey, a Bitcoin-themed bar in Greenwich Village, NYC, during National Cheeseburger Day.

He described the payment as “easy” and said it went through “quickly and beautifully.”

After the transaction, Trump, accompanied by bar owner Thomas Pacchia, greeted attendees. “This was one of the most important Bitcoin transactions of all time,” said Pacchia. “President Trump came to connect with and support the Bitcoin community. We are very excited he was here.”

Reference: Yahoo Finance, Cointelegraph

We are Hiring: Entrepreneur In Residence

As an Entrepreneur In Residence with HCM, you will lead and drive innovative projects related to building Bitcoin ecosystem. Leveraging your extensive background in business, technology, product development, marketing, and/or operations management, you will drive projects from the seed stage through capital market financing and growth, along with our resource supports. We seek leaders with a good understanding of the Bitcoin who can achieve breakthroughs in the international market.

Please send your resume to: account_admin@hcm.capital/yake@hcm.capital

For more information, please check out bitcoinerjobs.com

Lifpay is sponsoring Max & Stacy Invitational at EL Encanto Golf Tournament in January 2025, El Salvador

Reference: X.com

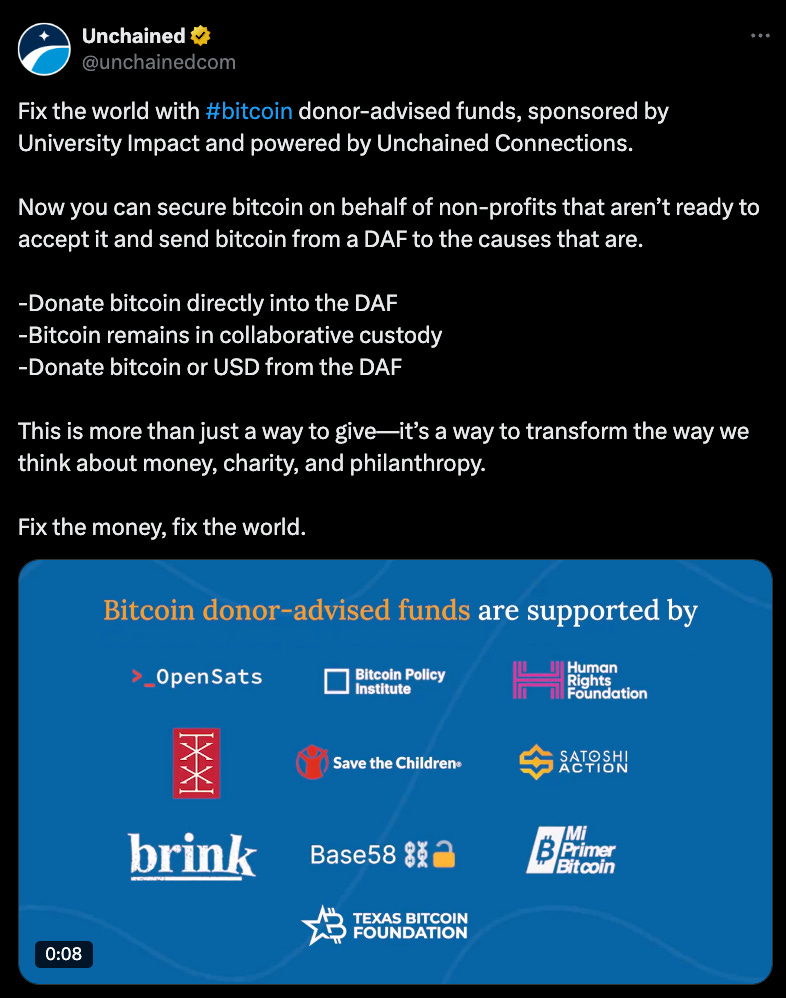

Unchained and University Impact Launch Bitcoin-Native Donor-Advised Funds to Streamline Charitable Donations and Maximize Tax Efficiency

Reference: X.com